A group representing the agents says it is having a negative impact in the state. A California auto insurance group has become quite vocal about their opinion against Commissioner Lara’s recent rate moratorium. According to the agents, the commissioner’s moratorium is negatively impacting state consumers. The American Agents Alliance has stated that they are opposed to Lara’s auto insurance rate moratorium in California. The alliance is based in Sacramento, California, and is an association of professionals in the insurance industry. “Commissioner Lara’s Rate Moratorium and his refusal to process automobile…

Read MoreTag: California insurance commissioner

How Insurance Can Encourage Farmers to Mitigate Climate Change Risks

The sweeping impacts of climate change impact farmers at significant rates. As a result, insurance companies take a hit as well. For example, when nearly 20 million acres of farmland flooded in the American West, it initiated $4 billion in payouts from a federal crop insurance program. Because of disasters like this, farmers are coming around on the importance of mitigating the impacts of climate change to protect their own livelihoods. Insurance companies can help farmers make beneficial sustainability choices by helping those in the agriculture industry understand their impact…

Read MoreCommissioner Lara doesn’t want easier rate changes for home insurance companies

The California Insurance Commissioner is siding with consumer activists to halt legislation. California Insurance Commissioner Ricardo Lara is taking the side of consumer activists in an effort to stop a bill that would make it faster and easier for home insurance companies to change their rates. AB 2167 passed the state Assembly on Monday by a vote of 56-3. That said, the bill’s opponents say that this would set the stage for home insurance companies to impose substantial premiums spikes for homeowners in parts of the state hardest hit by…

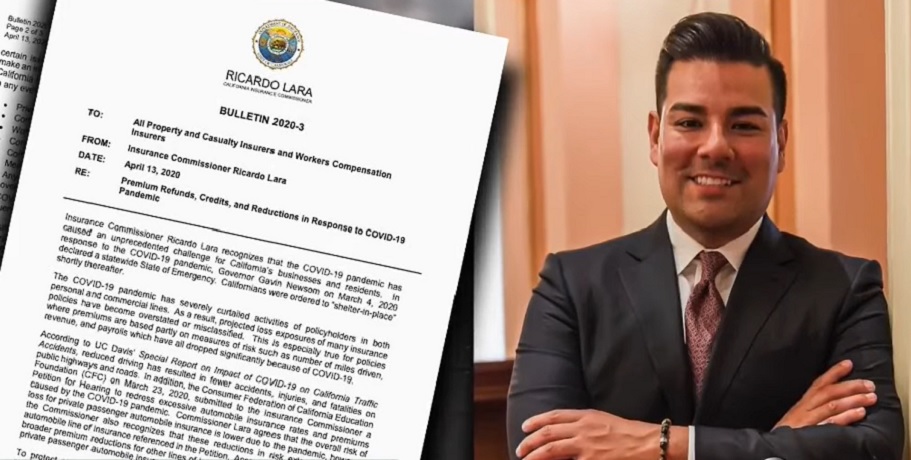

Read MoreCalifornia Insurance Commissioner orders premiums returned to businesses

Ricardo Lara has told insurers to return premiums on six lines of personal and commercial coverage. California Insurance Commissioner Ricardo Lara has ordered insurers to return premiums from certain lines to businesses and consumers. This has raised pressure on those insurers to take larger steps to reduce customer financial burden caused by COVID-19. Lara has ordered insurers to return premiums paid for March, April, and possibly May as well. The California Insurance Commissioner’s order applies to six different coverage lines. These include passenger and commercial auto, commercial multi-peril, workers compensation,…

Read MoreCalifornia Insurance Commissioner Ricardo Lara Apologizes for Accepting Industry Contributions

Lara released a letter last week that acknowledged that his campaign had solicited those contributions. California Insurance Commissioner Ricardo Lara has said he was sorry for having both solicited campaign contributions from the insurance industry and for having accepted them. Last Tuesday, he issued a letter in which he acknowledged the activity as well as his regret for having done so despite a campaign pledge he had made not to accept contributions from insurers. The letter was issued to a number of groups, including Public Advocates, United Policyholders and Health…

Read More