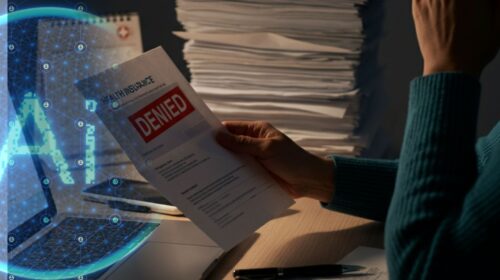

Artificial intelligence (AI) has revolutionized many industries, but its use in health insurance claims processing is stirring sharp debate. Health insurance giants like Cigna, Humana, and UnitedHealth Group are facing serious allegations over their use of algorithm-driven systems to deny claims at a staggering rate. With lives at stake and lawsuits piling up, the practice has raised deep ethical and legal concerns. The Allegations Against Industry Leaders The controversy largely centers on accusations that AI algorithms are being used to wrongfully deny claims, often in mere seconds. One lawsuit claims…

Read MoreCategory: Health Coverage

Daily articles posted on health insurance changes for all lines of business. Whether you are an agent or a small business owner you will be captivated in how much this industry is changing in the United States today.

Assisted Living Advantages for Independent Seniors

Assisted Living Advantages for Independent Seniors: Balancing Support and Freedom For many seniors, the idea of transitioning into an assisted living community can feel like a compromise between independence and the need for support. At Columbia Cottage in Pennsylvania, we believe that assisted living isn’t about sacrificing your independence; it’s about enhancing it. In fact, one of the greatest assisted living advantages is the ability to balance a vibrant, independent lifestyle with the security and personalized care that ensures your well-being. In this post, we explore how assisted living communities…

Read MoreBuilding Bridges in Healthcare and Insurance: How Collaboration Lowers Costs and Improves Care

Sharing Expertise for Better Coverage and Outcomes Healthcare and insurance are deeply connected—both fields thrive on teamwork. When doctors, nurses, insurers, and pharmacists align their efforts, patients benefit from smoother care and fewer financial surprises. By combining clinical expertise with insurance knowledge, professionals create a system focused on cost-effective, high-quality outcomes. Insurance providers play a key role here. Whether connecting patients with in-network specialists or ensuring treatments align with coverage plans, collaboration helps avoid unexpected bills. Imagine a collaborating doctor working with insurers to pre-approve a surgery or medication. This…

Read MoreCan AI Really Decide Your Medical Needs? Texas Says Not Alone

Texas Senator Pushes for Stricter AI Regulations in Health Insurance Claims AI in Health Insurance: A Double-Edged Sword The health insurance industry is increasingly turning to artificial intelligence (AI) to streamline processes like patient claims. AI promises faster results, reduced administrative costs, and fewer delays. However, as Texas lawmaker Senator Charles Schwertner highlights with his recently proposed legislation, this growing reliance on AI also comes with serious risks—especially when AI systems replace human expertise in critical medical decisions. Schwertner introduced a bill on January 16 that aims to limit the…

Read MoreTragedy, Reform, and the State of Health Care – A Look at UnitedHealth Group

A Shocking Loss That Shook a Nation The murder of Brian Thompson, the CEO of UnitedHealth Group’s UnitedHealthcare division, stunned the country in December 2024. Thompson, a 50-year-old husband and father of two, was fatally shot while walking to a company meeting in New York City. It was a crime that not only horrified his colleagues and family but also put a harsh spotlight on the broader frustrations with the U.S. health care industry. The accused, Luigi Mangione, reportedly had grievances about systemic issues in the health care system. He…

Read MoreMassive $21 Billion Medicare Boost Set to Transform Senior Healthcare in 2026

Proposed 2026 Medicare Advantage Reimbursement Rates See Positive Growth The Centers for Medicare & Medicaid Services (CMS) has proposed a 2.2% increase in reimbursement rates for Medicare Advantage (MA) plans in 2026, marking a sharp improvement from the 0.2% decline seen the previous year. When factoring in the 2.1% “risk score” adjustment to account for higher payments for individuals with severe health conditions, the total estimated increase in payments rises to 4.3%—equivalent to more than $21 billion. This proposal is poised to have a significant impact on insurers, healthcare beneficiaries,…

Read MoreCalifornia Health Insurance Law SB 1120 Takes a Stand Against AI-Driven Health Insurance Denials

California Enacts SB 1120 to Rein in AI-Powered Health Insurance Decisions California has taken a groundbreaking step in regulating the role of artificial intelligence (AI) in health insurance decision-making. Senate Bill 1120 (SB 1120), also known as the “Physicians Make Decisions Act,” prohibits health insurers from denying, delaying, or altering claims solely based on AI algorithms. Signed into law by Governor Gavin Newsom, this legislation ensures human oversight in healthcare coverage decisions, addressing mounting public concerns about fairness and accuracy in the use of AI technologies. Effective as of January…

Read More