These new figures show that there will be less of a gap between the most and least expensive policies. Recent insurance news out of Oregon has shown that residents in that state will be seeing a much slimmer range in the prices of health policies that will be sold on the exchange for individuals and small employers in 2015. This health insurance announcement was made by the regulators in the state. In essence, the primary message of this insurance news will be that the plans with the lowest premiums will…

Read MoreTag: Oregon insurance

Insurance technology dispute creates turbulence between Oregon and Oracle

Dispute between Oregon and Oracle threatens the capabilities of Cover Oregon Acclaimed technology firm Oracle has been at odds with the State of Oregon regarding its health insurance exchange. The exchange makes use of technology that has been developed by Oracle and this technology allows the exchange to operate as it is meant to. The problem, however, is that Cover Oregon is not yet fully developed and state officials have called into question the viability of Oracle’s insurance technology. The tension between the state and the technology firm had reached…

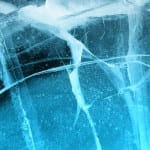

Read MoreOregon Insurance Division urges consumers to be cautious during the winter

Winter storms take their toll on Oregon Winter storms have been causing problems for homeowners and drivers recently. The U.S. has fallen victim to what is being called a “polar vortex.” This natural phenomenon has lead to freezing temperatures throughout the U.S. and significant snowfall in many parts of the country. States that do not typically see heavy snowfall, such as Georgia, have suffered from the impact of the polar vortex has snowfall causes damage to properties and creates dangerous driving conditions. In Oregon, state officials are issuing warnings when…

Read MoreOregon flood insurance premiums still charged to the wrong homeowners

The challenges that FEMA is facing within the state are clearly on the rise. Hundreds of homeowners throughout the state are finding themselves wrongly being required to pay Oregon flood insurance as they are caught up in the flaws of a system in which lenders automatically include properties located close to flooding zones in with those that are actually located in high risk areas. This means that properties nearby – but outside of – flooding zones, are deemed high risk by lenders. This is problematic for those homeowners as it…

Read MoreLong term care insurance company fined $115,000

Oregon regulators have slapped Bankers Life with the penalty regarding mishandling of claims. State regulators in Oregon have handed Bankers Life and Casualty Co. a massive fine of $115,000 because the long term care insurance company had been mishandling claims that were being filed by disabled and elderly policyholders. The fine was issued after the insurer had been found to have made dozens of violations to the regulations in the state. According to Laura Cali, the Commissioner in Oregon, “I think we’ve made it very clear to them that this…

Read MoreUsage based insurance concept is launched in Oregon

Technology will now be allowing drivers in the state to have premiums that reflect their behaviors. An auto insurer in Oregon, MetroMile, has announced that they will now be selling a usage based insurance policy that will calculate their premiums based on the number of miles that the motorist has driven. The insurer will be using a sensor installed in vehicles that records the miles driven in the vehicle. The company is taking a similar angle to a utility meter with the concept of usage based insurance, where the number…

Read MoreOregon senators give community car sharing programs a much needed boost

Oregon senators have given their approval to a bill that eliminates a number of the obstacles faced by emerging community car sharing programs, in an effort that would appear to be designed to increase participation in this environmentally friendly activity. The House Bill 3149 was approved in a 25-3 vote. This bill was designed to set the personal vehicle sharing program standards. It has added the necessity for these programs to provide motor vehicle liability insurance, and should injury or loss occur during a time when the vehicle is being…

Read More