The state’s rate bureau has requested the increase, which would go into effect this summer.

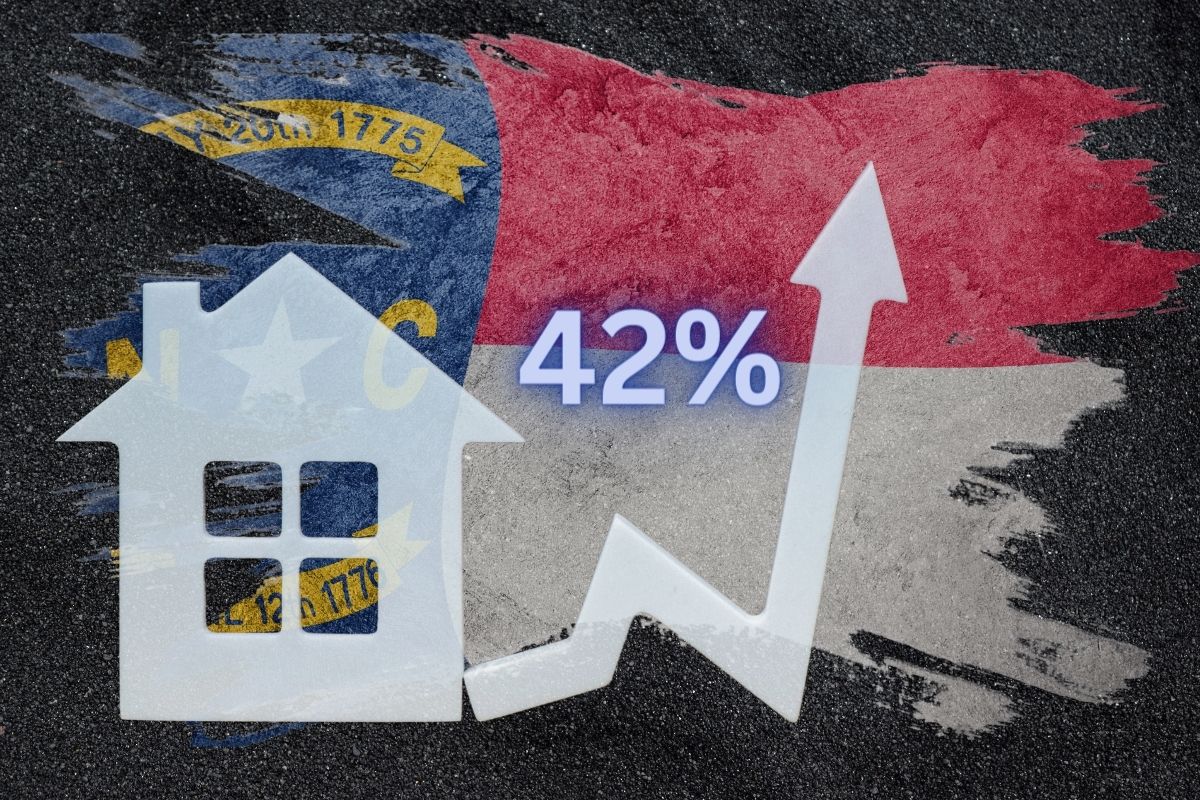

This summer, things could be heating up in North Carolina’s home insurance market, as the state rate bureau has requested a massive 42.2 percent rate increase that would go into effect on August 1 if approved.

The rate increase request was announced by NC Insurance Commissioner Mike Causey in a news release.

The North Carolina Rate Bureau (NCRB) represents home insurance companies that write policies in the state. It is an entity that is completely separate from the state’s Department of Insurance (NCDOI).

Drivers in the state only recently watched their auto coverage increase by an average of 4.5 percent, while motorcycle liability insurance rose by 2.3 percent. Both of those increases became effective in December 2023. Similar increases are likely to be seen in both types of vehicle coverage later this year as a result of an agreement achieved between insurers and the NCDOI.

Now, it is property coverage that is being considered for price hikes, and those increases could be substantial. Moreover, this is far from the only large increase property owners have experienced in recent years. For instance, in November 2020, the NCRB requested a 24.5 percent increase to rates from the NCDOI. The outcome of that rate hike filing was a settlement between the NCRZB and Causey for an average rate increase of 7.9 percent.

There remains time before the home insurance rate increase request has been decided upon.

A public comment period is being made available, through which the public can voice their opinions. These include:

- A January 22 public comment forum from 10am to 4:30pm in Raleigh.

- A virtual public comment forum held simultaneously with the above in-person event.

- Emailed comments, which must be sent to the applicable address by February 2.

- Written comments which must be received by mail by February 2.

The comments sent by the public will be shared with the NCRB. If the requested home insurance rate increases do not receive the agreement of NCDOI officials, they will be either negotiated with the NCRB or denied. If a settlement is not reached within 50 days, Causey will request a hearing.