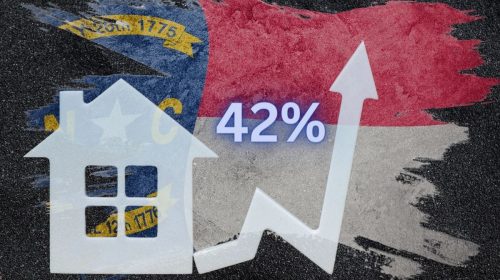

The state’s rate bureau has requested the increase, which would go into effect this summer. This summer, things could be heating up in North Carolina’s home insurance market, as the state rate bureau has requested a massive 42.2 percent rate increase that would go into effect on August 1 if approved. The rate increase request was announced by NC Insurance Commissioner Mike Causey in a news release. The North Carolina Rate Bureau (NCRB) represents home insurance companies that write policies in the state. It is an entity that is completely…

Read MoreTag: North Carolina Rate Bureau

North Carolina auto insurance customers will be paying more for coverage

Rates are expected to rise for many drivers in October, though the increase is less than what it might have been. North Carolina auto insurance rates may be on the rise in October, but drivers could have seen a much higher hike if regulators hadn’t stepped in. The state Department of Insurance signed a settlement agreement with the N.C. Rate Bureau to allow for a considerably lower rate increase than initially proposed. Insurance Commissioner Mike Causey made the announcement regarding the settlement agreement signing. Initially, the state Rate Bureau requested…

Read MoreHomeowners insurance rates in North Carolina are “very much a problem”

The commissioner in the state has openly recognized that there is an issue which must be overcome. Though the majority of people would say that they’re already paying high premiums for their homeowners insurance coverage, those in North Carolina have more to complain about than most, as the majority of property owners have seen their bills suddenly spike by a third to nearly three quarters of what it previously had been. Many people have received letters saying that if they don’t agree to these increases, they will lose their coverage.…

Read MoreHomeowners insurance rates in North Carolina heading up by 7 percent

The state regulator has now signed an agreement that allowed for the statewide increase. The leading homeowners insurance regulator in North Carolina has just given their approval to allow insurers in the state to increase their rates by an average of 7 percent per year, beginning in July. The original request had been much higher than that in October, but the Commissioner has found 7 percent to be justified. In October 2012, the North Carolina Rate Bureau had requested 17.7 percent, on average, as an increase across the state. Though Commissioner…

Read MoreNorth Carolina homeowners insurance companies called to justify rate increases

North Carolina homeowners insurance becomes target of regulatory action Insurance companies in North Carolina are being called upon to justify a proposed increase in insurance rates. According to the state’s Department of Insurance, many homeowners insurance providers have proposed an average rate increase of 18% throughout the state. The proposition has caused some turmoil amongst consumers who consider such an increase to be unfair. Insurance Commissioner Wayne Goodwin is now calling upon North Carolina homeowners insurance companies to provide more information on why they believe the rate hikes to be…

Read More