The use of these unmanned aerial vehicles has been adopted by Allstate, State Farm and other major property insurers. Property insurance companies in Texas and Louisiana, such as Allstate and State Farm, are preparing to use their insurance drones to survey the aftermath of Hurricane Harvey. This insurance technology is expected to have an important role in inspecting commercial and residential damage. The insurance drones will first take to the air early this week, once the last of Hurricane Harvey makes its way out of the regions. If all goes…

Read MoreTag: hurricane harvey

Federal flood insurance program stuck on hold as Hurricane Harvey tallies climb

Southeastern Texas was devastated by the storm, placing the focus back on NFIP and the GOP restructuring effort. The Federal flood insurance program is in limbo at the moment while Texans face catastrophe following Hurricane Harvey. The Republicans have been trying to restructure the National Flood Insurance Program (NFIP). Their goal has been to partially privatize it. NFIP is a subsidized program that costs taxpayers tens of billions in federal subsidies. The federal flood insurance program is facing an upcoming deadline of September 30. Unless Congress agrees to extend the…

Read MoreNew Texas insurance law may make things harder for Hurricane Harvey victims

As the very first steps for recovery begin, HB 1774, signed into law by Texas Governor Greg Abbott (R) becomes effective. A Texas insurance law, signed by Governor Greg Abbott back in May, will become effective tomorrow. This, at a time when Hurricane Harvey victims are taking the very first steps toward understanding what they can do to recover. Houston, the fourth most populous city in the United States, may have years of recovery ahead. The Texas insurance law will be changing the way claims lawsuits are handled when they…

Read MoreHurricane Harvey damage to be among “top 10 most costly” for insurers, JPMorgan

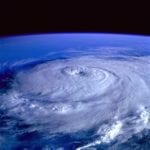

The financial services company told its clients that the costs could be between $10 billion and $20 billion. JPMorgan informed its clients that the Hurricane Harvey damage left behind in Texas could be as high as $10 billion to $20 billion. This would place it among the “10 most costly” hurricanes to make landfall in the United States, said the company. The storm first struck Texas last weekend and was a Category 4 at the time, before being downgraded. Gradually, it wound itself down to tropical storm status, though it…

Read MoreHurricane insurance companies are preparing for a busier season than usual

As Harvey makes its way closer to Texas, insurers are bracing for the impact of landfall. Forecasters and hurricane insurance companies alike are watching both Harvey and the rest of the Atlantic storms that are brewing. The season is expected to be more active than average and it is far from over. In fact, the Atlantic hurricane season has only just reached its peak and will continue until November. Many meteorologists and weather monitoring organizations have upgraded their initial forecasts for the season. Though it was originally expected to be…

Read More