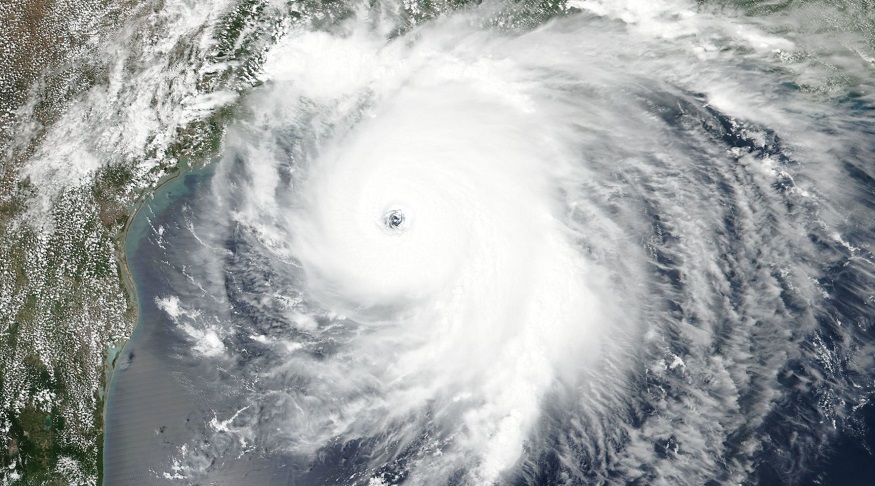

Many property owners aren’t taking into consideration the additional challenges from COVID-19. Even after the devastation left behind by the major storms last week, most homeowners feel they have made adequate hurricane preparedness efforts, according to a recent survey. When Hurricane Laura reached the US Gulf Coast, it struck as a highly powerful category 4. According to the research conducted by ValuePenguin, most homeowners – 86 percent – feel that the hurricane preparedness steps they have taken are enough. However, thousands of people who were in the path of last…

Read MoreTag: homeowners insurance coverage

Many US homeowners are shocked at how high their flood risk score really is

Every American homeowner is finding out how much of a risk their property is truly facing. This month, every current and potential homeowner in the United States has access to the flood risk score of their property (or one they are considering for purchase). Many find themselves amazed at how high their property’s risk of flooding has been assessed to be. America’s flood risk score is being reassessed by First Street. This is a part of a broader effort to provide current homeowners and prospective home buyers, and the real…

Read MoreA homeowners insurance review is important at the start of every spring

Property coverage should be re-examined annually, and this season presents a good opportunity. Experts in the industry typically recommend that property owners conduct a homeowners insurance review once per year, and the spring is an ideal time to do it. The start of this season allows property owners to ensure they have adequate coverage for the year ahead. With the fresh starts that come with springtime, a homeowners insurance review can help policyholders to ensure that their coverage is still appropriate for their needs. This way, they can know that…

Read More5.7 magnitude Utah earthquake places spotlight on insurance coverage

The quake struck the state on Wednesday morning, knocking out power and shaking residents. The 5.7 magnitude Utah earthquake that struck on Wednesday morning has reminded residents and business owners of the importance of coverage. Around 55,000 people were left in the dark from power outages in the Salt Lake City Area. The magnitude of the Utah earthquake was reported by the US Geological Survey, and the power outage figures were released by Rocky Mountain Power. Local news reports shared that many people in the region were startled by the…

Read MoreAllstate warns policyholders of home break ins spike at this time of year

The insurance company is reminding its customers to be vigilant throughout December. December is often the month with days in which there is most likely to be home break ins, according to a reminder from Allstate Insurance. In Texas, for example, the first of the month is traditionally the busiest for burglars breaking into houses and apartments. According to the insurer, this trend has been ongoing, driven by a rise in holiday shopping. With Thanksgiving, Black Friday, and sometimes Cyber Monday falling on or before December 1, that day has…

Read MoreSolar panel insurance keeps your green energy investment covered

Many homeowners don’t realize that they need to add coverage to their eco-friendly additions. Across the country, homeowners and businesses alike are making efforts to shrink their carbon footprint but many forget to add solar panel insurance to cover their substantial investments. Getting coverage for your green energy additions is typically quite easy to do. The average rooftop solar panel system will usually cost somewhere between $15,000 and $25,000, according to data from the Center for Sustainable Energy. A good chunk of the cost has the potential to be offset by…

Read MoreWhat does California earthquake insurance coverage provide following a disaster

Following the tremors last Thursday and Friday, many residents are looking into the protection available. The importance of California earthquake insurance coverage was placed in the spotlight last Thursday and Friday. The 6.4 magnitude quake was the strongest to rock Southern California in two decades and was followed by a 7.1 magnitude quake the next day. The tremors shook homes and other buildings across hundreds of miles in the state. Independence Day came with a number of different catastrophe risks, particularly with the number of tornadoes that have been cutting…

Read More