Legislators in Baldwin, Alabama, are working toward a measure that would add $478,000 annually to flood insurance premium savings for its residents. Baldwin first entered the Community Rating System in 1995 in order to obtain better flood insurance rates on behalf of its residents. According to the system, counties that fare well in rating are eligible for discounts for insurance in the categories they score well in.

Legislators in Baldwin, Alabama, are working toward a measure that would add $478,000 annually to flood insurance premium savings for its residents. Baldwin first entered the Community Rating System in 1995 in order to obtain better flood insurance rates on behalf of its residents. According to the system, counties that fare well in rating are eligible for discounts for insurance in the categories they score well in.

Baldwin currently ranks 7 out of 10, and enjoys a 15% discount in rates. These numbers could increase if the county’s proposed modifications to the system are passed. Nancy Mackey, Baldwin County Planner, said that the modifications could net residents an additional 20% in discounts in flood hazard areas and another 10% in non-hazard areas.

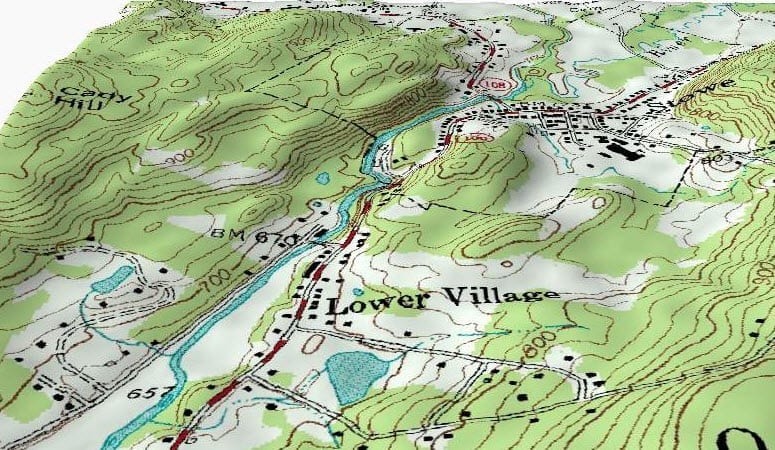

According to Mackey, 17% of the county’s population resides in areas at risk for flood damage. Some 9,783 policies are currently in force, worth more than $2 billion in coverage. If the proposed modifications are successful, Mackey expects that premiums will drop by $256,000 per year.

There are a number of factors that contribute to the scoring process and the key to passing the modifications is to keep these components in balance. Building inspections play a role and according to Mike Howell, County Building Officer, the recession has taken a toll on the number of inspectors at his disposal – only four inspectors were present to cover all county areas.

Howell is adamant in his efforts to ensure the county’s rating is not affected by the lack of inspectors and has suggested that areas without homes should be removed from the flood hazard map.

Mackey has said that a presentation regarding the program will be posted on the county’s website. FEMA will release its official ratings in the months to come.