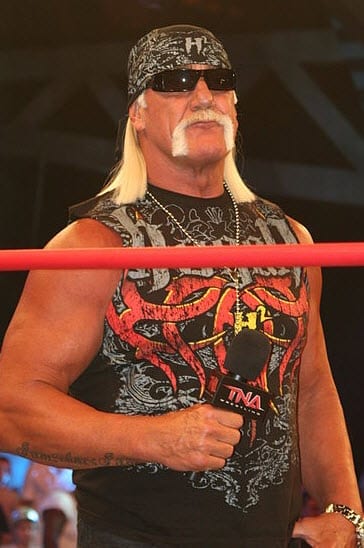

The former wrestling star, Terry Bollea aka Hulk Hogan, is learning the hard way about proper insurance coverage limits.

Hogan’s son was involved in a car accident in 2007 resulting in serious injuries to his passenger, John Graziano. At the time of the incident the Hogan’s only had a limit of $250,000 bodily injury liability…no umbrella or excess liability. Totally exposed and unprotected, a second lawsuit for negligence has been filed on April 22, 2010, now attacking his personal assets.

Many think this situation will never happen to them, plus not many have celebrity status, which makes for a “sitting duck” circumstance, right? Wrong…you’d be surprised how many people find themselves “underinsured” due to this line of thinking. If disaster strikes, a lawsuit can clean out your savings accounts, can force you to liquidate your investments, and possibly even sell assets like your home – this can happen to the average guy and does every day! When sizing up your liability coverage consider this…if you have young drivers, like Hogan did, and you own a home – make sure you have an umbrella in place. Remember, property, retirement accounts, college savings, any assets can be vulnerable if sued. Umbrella coverage, on average, can run $250 to $450 a year, which is nothing if something goes wrong, plus it offers a blanket of liability over your home as well as your cars.

Hogan is now including his ex-wife on this second suit, stating she helped in securing this coverage, and should be held responsible too. In many high profile cases like this one, a business manager should be trained in spotting loop holes as well as having an agent to offer advice. The insurance company Hogan had at the time, Wells Fargo Southeast, is a direct carrier.