Setting Opinions Aside: An Objective Look at Wildfire Insurance In the wake of devastating wildfires across the country, the House Financial Services Committee has taken a significant step towards addressing the growing concern over insurance coverage for damages resulting from such disasters. With a strong bipartisan backing, the committee has forwarded a bill that mandates a comprehensive study on the state of wildfire insurance. Rep. Patrick McHenry, R-N.C. and chair of the committee, emphasized that the conversation about wildfires must transcend the usual debate on climate change, focusing on observable…

Read MoreCategory: Political News

The political arena is ripe with news from the insurance industry – 2012 being a presidential election year, as well as other changes, have made for one of the hottest news topics we have.

Louisiana home insurance to see major changes, says new state commissioner

As the state aims to find a way to repair its current crisis, it is making sweeping changes Louisiana residents are about to see a number of widespread changes to home insurance in the state as the new commissioner Tim Temple aims to fix the crisis in the state. Temple is determined to correct the state’s crisis “Louisiana has a very heavy-handed regulatory reputation,” said Temple. “We’re changing that.” Last week, he outlined a number of sweeping changes to the home insurance regulations in the state, making it possible for…

Read MoreAllstate puts a halt to Colorado Spanish-language insurance sales due to new law

State lawmakers passed a translation requirement leading the insurer to conduct business in English. Allstate will be stopping all insurance sales conducted in Spanish and will do business exclusively in English in Colorado when a new law goes into effect in 2025. House Bill 23-1004 requires insurers to provide consumers with policy documents in the same language as advertising. The law will mean that policy documents provided to consumers will need to be written in the language in which the company advertises. Therefore, if a company advertises in Spanish, the…

Read MoreNew bill introduced in California to help overcome homeowners insurance crisis

The federal bill was proposed by state Representative Adam Schiff (D-Burbank) last week. Last Wednesday, California Representative Adam Schiff (D-Burbank) introduced a new federal bill with the intention of leaving behind the crisis in the homeowners insurance market and propping it back up again following the exit of several insurers from markets across the country. The legislation is called the INSURE Act and would correct the issue through federal reinsurance. The INSURE Act stands for Incorporating National Support for Unprecedented Risks and Emergencies Act. The idea behind it is to…

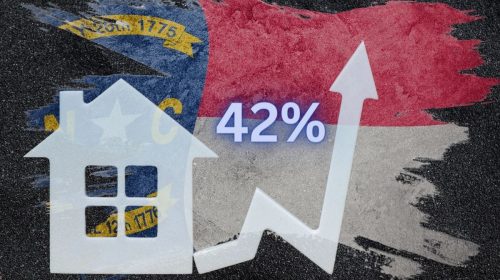

Read MoreNorth Carolina home insurance customers could see 42 percent rate hike

The state’s rate bureau has requested the increase, which would go into effect this summer. This summer, things could be heating up in North Carolina’s home insurance market, as the state rate bureau has requested a massive 42.2 percent rate increase that would go into effect on August 1 if approved. The rate increase request was announced by NC Insurance Commissioner Mike Causey in a news release. The North Carolina Rate Bureau (NCRB) represents home insurance companies that write policies in the state. It is an entity that is completely…

Read More