A recent Forbes Advisor survey showed that most drivers feel they are overpaying for their coverage.

Nearly 60 percent of American drivers believe that they are overpaying for their auto insurance coverage, according to a survey conducted by a team at Forbes Advisor.

The survey examined the various pricing factors for auto insurance and American drivers’ opinions on the use of those factors to calculate their premiums.

The research involved the participation of 2,000 drivers across the United States. It found that there were certain issues used for calculating premiums that many drivers felt should not be included in quotes, even if they were likely to benefit from them.

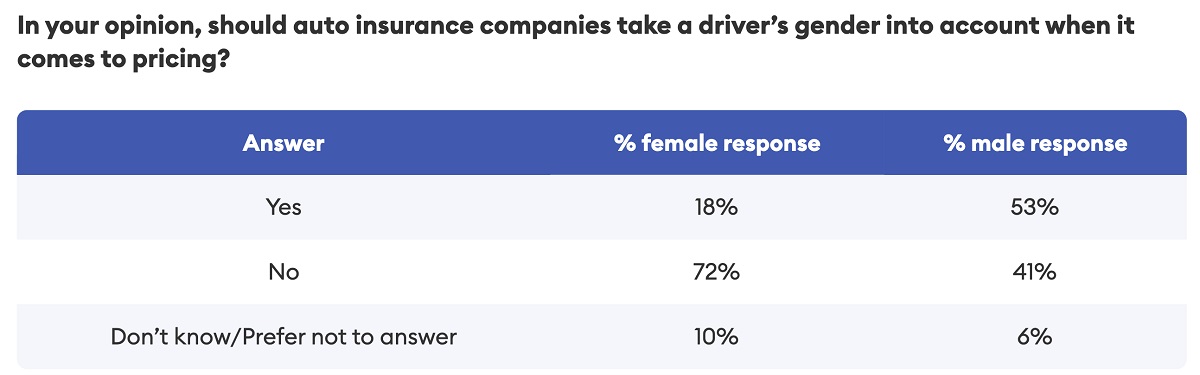

For example, even though women usually pay lower premiums than men, the survey showed that 72 percent of female drivers feel that gender shouldn’t be factored into premiums calculations in quotes.

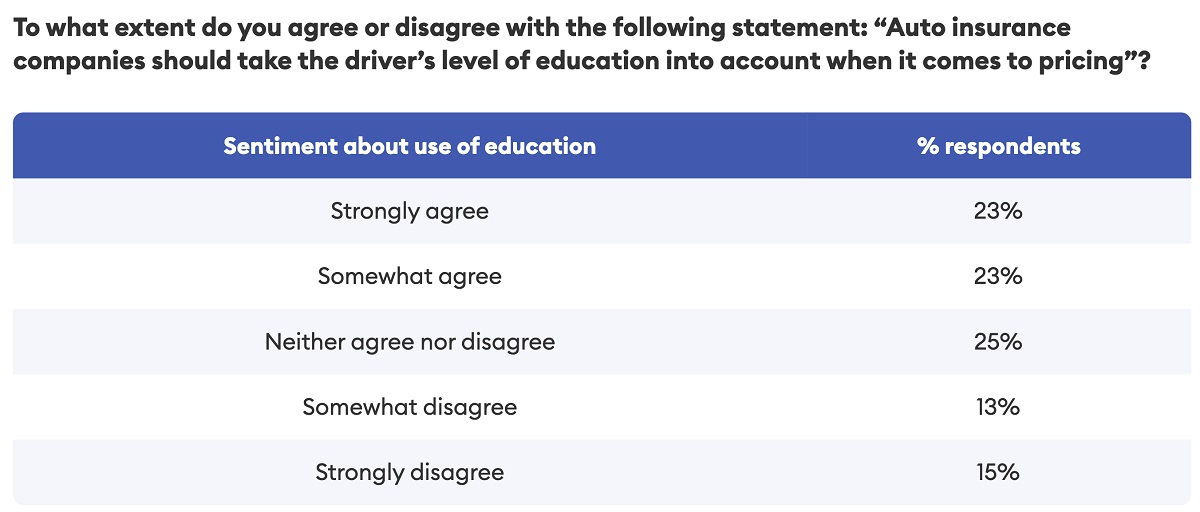

More drivers now feel that education should be factored into auto insurance quotes than last year.

In this year’s survey, 46 percent of respondents said that they felt that it was appropriate for a driver’s education level should be used as a factor to calculate their car insurance rate.

This is more than double the number of people who felt that an advanced degree would make them a better driver last year, when only 21 percent of respondents said it was appropriate to use education level to calculate premiums.

Other survey findings included:

- 58 percent of US motorists felt it was appropriate for their occupation to affect how much they paid for their coverage. Some insurers offer discounts for specific professions such as teachers, government employees, and police officers. Alternately, certain other professionals – such as restaurant servers and Uber drivers – often pay more for coverage.

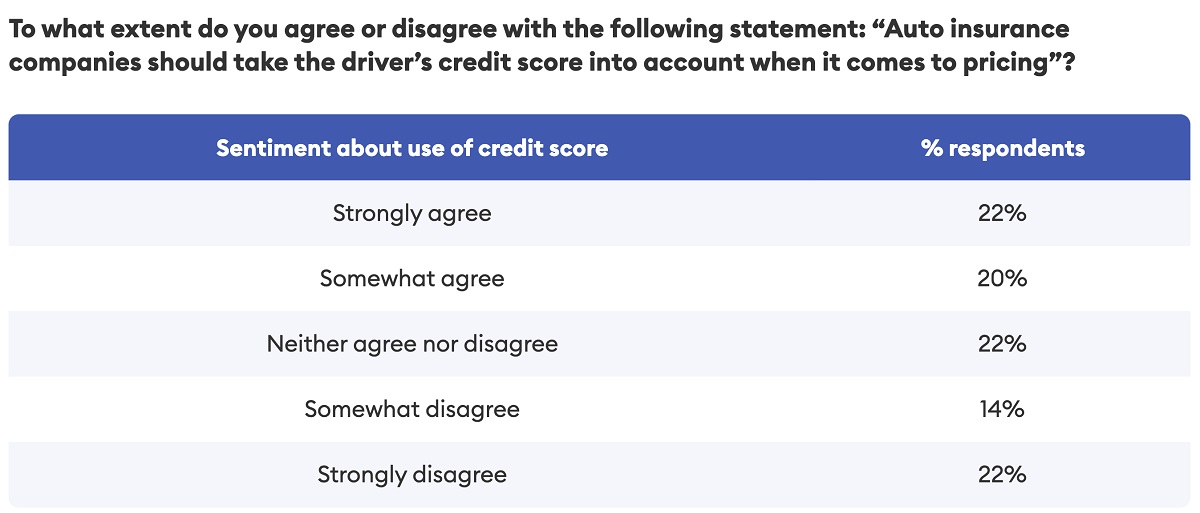

- 42 percent of auto insurance customers agreed that a person’s credit score should impact their rates, a massive increase over last year’s 22 percent.

- 40 percent of Millennials and 53 percent of male drivers said that gender should be factored into their quotes, even if those two groups are more likely to have to pay more.