Men are taking the lead in decision-making across most aspects of financial planning, according to HSBC’s latest report: The Future of Retirement: Why family matters. Conducted by Cicero Consulting across over 17,000 people in 17 countries, with more than 7,300 from Asia, HSBC’s survey explores changing attitudes towards retirement and financial planning.

Men are taking the lead in decision-making across most aspects of financial planning, according to HSBC’s latest report: The Future of Retirement: Why family matters. Conducted by Cicero Consulting across over 17,000 people in 17 countries, with more than 7,300 from Asia, HSBC’s survey explores changing attitudes towards retirement and financial planning.

Sixty-eight per cent of Asian men and 65% of men worldwide say they make all or most of the financial decisions in the household, compared to 58% and 53% of women in Asia and globally, respectively. The only exception in Asia is China, where 63% of women claim they make all or most of the financial decisions, compared to 58% of men. Managing the household budget is the only area where more Asian women on average, 35% compared to 30% of men, are taking sole responsibility.

In terms of retirement planning, only 29% of Asian women on average are most likely to take sole responsibility, compared to 37% of men: India (21% women vs 43% of men), Singapore (21% vs 38%), Malaysia (27% vs 33%), Hong Kong (28% vs 38%) and South Korea (32% vs 35%). In China, this is true for 36% of both genders and in Taiwan, for more women (39%) than men (35%).

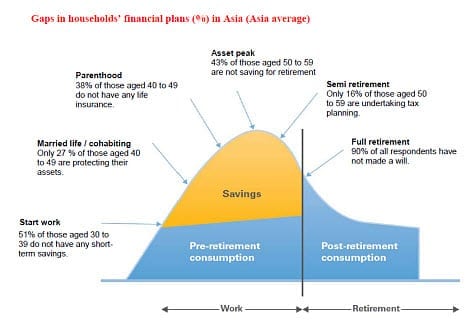

Louisa Cheang, HSBC’s Group General Manager and Regional Director for Retail Banking and Wealth Management, Asia-Pacific, said: “The gender divide in saving for retirement persists in Asia, leaving women potentially exposed to financial hardship in later life. We expect a narrowing of this gap as more women in the emerging world receive education, join the workforce or start a business and make more decisions for themselves and their families. It is important that financial planning decisions that affect the household, in particular retirement and protection needs should be shared and discussed between partners to ensure that both are better prepared for retirement and other life goals and that most of the family’s financial needs are considered and taken care of.” HSBC’s new report points to a myriad of evolving financial needs as individuals and families go through various life stages. Across Asia, 66% of respondents on average, say they have a financial plan in place, yet despite these plans, there appear to be significant gaps in the financial planning throughout adult life.

For example, six in 10 Hong Kong respondents aged 30-39 years old do not have any short-term savings. Only 19% of Taiwanese aged 40-49 are protecting their assets. Forty eight per cent and 47% of parents in Malaysia and Hong Kong, respectively, have no life insurance. Three in four South Koreans (76%) in their 50’s are not saving for retirement. In Singapore and Hong Kong, only a tenth (12% and 10%, respectively) in their 50’s are undertaking tax planning with 80% and 94% of all respondents, respectively, without a will.

Ms Cheang said: “Life events are useful prompts to either start or review a financial plan. Being able to manage a household income and build financial assets for the long term, while protecting against financial risks throughout life, will be critical for Asian families in the 21st century. Asians need to balance the need to protect wealth and investments in the short- and medium-term with the need to generate an adequate retirement income in the long-term.”

Across Asia 23% of respondents regard themselves as conservative investors, with women (28% vs 20% of men) more likely to sacrifice returns to protect their investment. This general risk aversion is also reflected in how people are currently saving for retirement.

• 54% of Asians fund retirement via cash savings accounts and nearly half (49%) hold insurance ie endowments and investment-linked insurance, led by Singapore (72% and 67%, respectively);

• A third (33%) rely on state pensions such as social security, led by China (67%);

• Thirty-one per cent invest in bonds and term savings accounts and 29% hold mutual funds and investments, led by India (40% and 55%, respectively); and

• Over a fifth of Asians on average invest in annuities to fund retirement.

Ms Cheang added: “Asians tend to apply a do-it-yourself approach combined with advice from family, friends and occasionally, a professional financial advisor. HSBC works closely with our customers to understand their needs and provide integrated solutions that harness our strengths in insurance, wealth and asset management to help customers protect and growth their wealth for every stage and ambition of their life.”

For more information:

www.hsbc.com/retirement/future-of-retirement