As exciting as it can be, planning and hosting an event usually comes with a certain level of risk. No matter how well-organized and carefully planned an event may be, unexpected accidents and incidents can occur, which can lead to liability claims and financial losses. This is where insurance comes in. Insurance provides a safety net for event organizers and participants, helping to mitigate potential risks and cover the costs of unexpected incidents. However, not all insurance policies are created equal, and it’s important to understand the different types of…

Read MoreTag: wedding insurance

Many wedding insurance policies are changing shape due to the pandemic crisis

Several carriers have been altering their coverage since COVID-19 lockdowns started taking place. Since the start of the pandemic crisis, claims on wedding insurance policies have been pouring in. This has had two major impacts on the market for this particular product. The first is that awareness of its existence has skyrocketed. The second is that many insurers have been working to change the coverage these products provide. Many engaged couples are seeing this type of coverage as essential for the first time. Since March 2020, when COVID-19 slammed many…

Read MoreEngagement ring insurance spikes with Valentine’s Day proposals

It may not seem romantic, but many consumers are choosing to purchase coverage for this sizeable investment. As people across the country get ready to pop the question on Valentine’s Day, they are also purchasing engagement ring insurance coverage. These policies are meant to provide protection against the unexpected. After all, this piece of jewelry is considerably more expensive than a box of chocolates or a bouquet of roses. It’s clear that a growing number of people are hanging onto their financial sense even in romantic moments. Before people get…

Read MoreWedding insurance can protect Valentine’s Day marriages

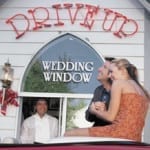

These policies are beginning to become big sellers, particularly around this time of year. Although wedding insurance has never been one of the top selling policies – particularly compared to the standards such as home, health, life and auto – this business is picking up quite dramatically, and experiences certain popular seasons such as around Valentine’s Day and during the summer months when the most marriages take place. These marriage insurance policies help to protect the investment of the day itself against many perils. The importance of this coverage is…

Read MoreWedding insurance becoming more common among Americans

With the increasing cost of getting married and everything that it entails, more couples are purchasing coverage. The average cost for Americans to get married is now approximately $26,000 and, to an increasing degree, couples are purchasing wedding insurance to help to cover themselves against the sizeable financial losses that could occur as a result of illness, extreme weather, or even a sudden change of heart. The coverage isn’t offered by a large number of insurers in the U.S. but the number may soon grow. At the moment, wedding insurance…

Read More