A recent analysis conducted by The Travelers Companies has revealed some significant trends. According to the results of a homeowners insurance claims data analysis conducted by The Travelers Companies Inc., weather incidents were the cause behind more than half of all the filings that were made by policyholders. Among the events that were most commonly at fault were wind, frozen bursting pipes and leaky roofs. Despite the fact that the most common homeowners insurance claims were those caused by weather damage, it was the fire damage claims that were the…

Read MoreTag: wind damage

Insurance industry is beginning to respond to evolving global market

Insurers and reinsurers are adopting a new approach to their markets Insurance and reinsurance companies are beginning to re-evaluate their business models as prices begin to soften throughout the global market. Risks are beginning to evolve and new investors are beginning to power changes within the commercial insurance market. These changes are encouraging companies to change the way they approach their chosen market sectors in order to better accommodate demand and ensure their continued sustainability. Companies are also feeling a greater need to balance their exposure to certain risks, especially…

Read MoreWind insurance program in South Carolina watches homeowners exit

This pool which is a coverage option of last resort, has been seeing its participants dwindle for 3 years. According to the South Carolina Wind and Hail Underwriting Association, the number of homeowners who have been leaving the state’s last resort wind insurance pool has been continuing over the last three years. The program is meant for homeowners who can’t obtain this coverage anywhere else. For some time, the special wind insurance pool program was the only option that many homeowners had available to them. However, this state backed coastal…

Read MoreA Cluster of Winter Storms Slams the UK over the Holidays: AIR Worldwide

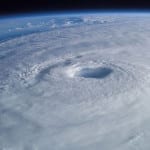

BOSTON, Dec. 28, 2013 — According to catastrophe modeling firm AIR Worldwide, over the last several days, a series of three winter storms (named Christian, Dirk, and Erich) cut power to hundreds of thousands of homes across the UK and France and flooded an estimated 1,200 homes across the UK. As of Friday afternoon local time, an estimated 13,000 homes were still without power. Trains, ferries, and aircraft have experienced significant delays and cancellations. Extratropical cyclones, also known as winter storms, form when a warm, tropical air mass interacts with…

Read MoreMassive EF-5 Tornado Causes Destruction in Moore, Oklahoma

BOSTON, May 21, 2013 – According to catastrophe modeling firm AIR Worldwide, at 3:01 p.m. on Monday, May 20, 2013, a massive tornado struck Moore, Oklahoma, a suburb of Oklahoma City, destroying many homes, businesses, and public buildings, including two elementary schools and a hospital. According to reports and aerial images, property damage in the affected region is extensive, with whole neighborhoods heavily damaged or destroyed. “A slow-moving upper level low pressure system triggered a series of severe thunderstorm outbreaks across the Central Plains starting on May 19,” said Dr.…

Read MoreHurricane Rafael Bypasses Bermuda: AIR

BOSTON, Oct. 17, 2012 – According to catastrophe modeling firm AIR Worldwide, Rafael became the season’s 9th hurricane on Monday after tracking through the Leeward Islands. The storm then bypassed Bermuda late Tuesday evening. As of the National Hurricane Center’s (NHC) 5:00 AM EDT advisory, the storm remains a Category 1 hurricane with a minimum central pressure of 974 mb and maximum sustained winds of 80 mph. Rafael is currently located approximately 310 miles northeast of Bermuda and is moving to the north-northeast at 33 mph. “The storm’s center passed…

Read MoreAIR Estimates Insured Losses in the U.S. from Hurricane Isaac of between USD 700

Hurricane Isaac Damage Report: Catastrophe modeling firm AIR Worldwide estimates that insured losses from Hurricane Isaac to onshore properties in the U.S. will be between USD 700 million and USD 2 billion. AIR estimates include wind and storm surge damage to onshore residential, commercial and industrial properties and their contents, automobiles, and time element coverage (additional living expenses for residential properties and business interruption for commercial properties). “Isaac made two separate landfalls, both as a Category 1 hurricane,” said Dr. Tim Doggett, principal scientist at AIR Worldwide. “The first occurred…

Read More