In an announcement that may reshuffle the deck for homeowners’ insurance across California, industry giant State Farm revealed a strategic shift in their coverage plans, affecting thousands of property and commercial apartment policies in the state. With implications extending to the very nature of wildfire and earthquake risk management, this move by State Farm is poised to remove billions in risk from the company’s books. Earthquake Aftermath Concerns Amplify Fire Risks in California While earthquake policies in California are indeed underwritten through the state-run California Earthquake Authority, State Farm’s heightened…

Read MoreTag: risk assessment

Unraveling Florida’s Insurance Exodus: Weather or More?

Florida, a state synonymous with sun-kissed beaches and, unfortunately, hurricanes, is caught in a whirlwind of an insurance crisis. Insurance companies seem to be abandoning ship despite a 2023 mild hurricane season. The exodus begs the question: What’s really prompting these insurers to run for the hills? Weather Warnings vs. Reality The threat of hurricanes has long cast a shadow over the sunshine state, prompting persistent fears that insurers are dwindling due to natural disasters. And indeed, the increased risk of such events has influenced insurers’ decisions. But to attribute…

Read MoreRevolution or Invasion? Automakers Sharing Driving Data with Insurance Companies

In the recent article titled, “Automakers Are Sharing Consumers’ Driving Behavior With Insurance Companies,” by the New York Times, the argument unfolds around the alliance between automakers and insurance firms. The central tenet of the paper uncovers a practice where car manufacturers transmit driving behavior data to insurers. This article explores the potential ramifications on insurance premiums, privacy concerns and consumer habits. The Impact on Insurance Premiums The sharing of driving data stands to revolutionize the insurance industry. On one hand, it can be a boon for safe drivers who…

Read More10 Dog Breeds Often Excluded by Homeowners Insurance

Understanding the Impact of Dog Breeds on Home Insurance: A Closer Look at Misconceptions and Facts Dogs are not just pets; they’re part of the family. However, when it comes to insuring your home, not all furry family members are viewed the same by insurance companies. Some breeds have a reputation that might make homeowners insurance providers think twice. While it’s true that some dog breeds are considered more of a risk due to their size, strength, or the lineage they come from, it’s essential to remember that with the…

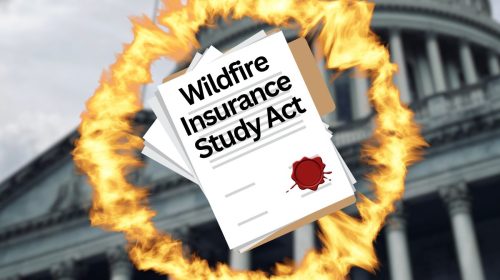

Read MoreHouse Committee Gives Green Light to Wildfire Insurance Coverage Study

Setting Opinions Aside: An Objective Look at Wildfire Insurance In the wake of devastating wildfires across the country, the House Financial Services Committee has taken a significant step towards addressing the growing concern over insurance coverage for damages resulting from such disasters. With a strong bipartisan backing, the committee has forwarded a bill that mandates a comprehensive study on the state of wildfire insurance. Rep. Patrick McHenry, R-N.C. and chair of the committee, emphasized that the conversation about wildfires must transcend the usual debate on climate change, focusing on observable…

Read More