New partnership between Japanese and British companies works to broaden the industry. Itochu Corp, a company that has set its sights on becoming the most profitable trading house in Japan aside from the mineral resources industry, has announced the latest insurance news of a new alliance with Antares Managing Agency Ltd. from the United Kingdom, in order to broaden the insurance industry. The alliance represents a number of important firsts within the industry in Japan. The partnership with Antares, which is based in London, with Itochu, will represent the first…

Read MoreTag: latest insurance news

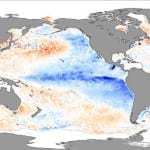

Insurance industry becoming a fierce opponent of climate change

Insurance industry continues to consider climate change a problem The insurance industry has long been attuned to the potential threat represented by climate change. For some insurers, climate change is not an issue of debate, as they are primarily concerned with the intensity and frequency of natural disasters. Over the past two years, the insurance industry has seen trillions in losses associated with uncharacteristically powerful natural disasters, such as Hurricane Sandy, which struck the U.S. in late November. Though climate change remains a volatile subject in the world of politics…

Read MoreInsurance news released to Madoff victims with claims

An appeals court has ruled that filings can be made for actual losses that were suffered. A New York state appeals court has made insurance news by ruling on the case regarding the types of claims that can be made by the victims of Bernard Madoff’s Ponzi scheme that bilked millions of dollars from those involved. The ruling allows the victims to make claims based on the actual losses that they suffered. This means that while the insurance news is good, in that they can make some claims, they will…

Read MoreInsurance news from HSBC includes intention to sell Ping An stake

A share of approximately $9.3 billion of the Chinese insurer will be sold. The latest insurance news from HSBC is that it is currently in negotiations to sell its stake of the Chinese insurer, Ping An, which is worth approximately $9.3 billion. The intention is to boost the profitability of this largest bank in Europe. It will be accomplished as a part of a larger effort to slough away some of its non-core operations. The sale of the Ping An stake is not unexpected insurance news. It was relatively anticipated…

Read MoreInsurance news from Germany warns residents of increasing premiums

The GDV industry association has said that the rise will be 1.5 percent this year. The GDV has just announced the latest insurance news, that insurers in Germany, including Talanx AG and Allianz SE, will likely be posting an increase in their premiums of 1.5 percent by the year’s end. It is believed that the premiums growth will increase to €180.7 billion ($230 billion). Among the explanations for these premiums increases are that the country has seen some of the highest levels of property and casualty growth that it has…

Read MoreInsurance news from Ghana may send health system into bankruptcy

A study from the World Bank has shown that this could occur as early as 2013. The World Bank has released the results of their latest study, which has revealed the devastating insurance news regarding Ghana’s health coverage system and its direction toward bankruptcy in 2013. As soon as next year, the National Health Insurance Scheme (NHIS) could be bankrupt. The insurance news report stated that “the system has serious structural and operational inefficiencies and is on a trajectory to go bankrupt as early as 2013.” It went on to…

Read MoreInsurance news after Sandy has stocks tripping and falling

Despite the solid report in October, the insurers dropped sharply in the markets. Whether you call it the Superstorm or the Frankenstorm, the impact of Sandy on insurance news has been a significant one, particularly considering the damage it had on the stocks of insurers at the start of November. The Dow Jones industrial average fell by 139 points as more information about Sandy’s costs was revealed. Of course, the falling stocks were not limited exclusively to insurance news, as many large companies – such as Verizon Communications – that…

Read More