It is estimated that the average premiums will drop by 12.6 percent across the state, starting April 15. The largest homeowners insurance company in California has just announced that it will be reducing its rates across the state by an average of 12.6 percent for over one million customers, as of halfway through April. The average customer should expect to see an annual reduction in premiums of about $100 in 2013. The actual drop that will be seen in the rates paid by consumers will vary from one area to…

Read MoreTag: homeowners insurance premiums

Homeowners insurance in Ohio among the cheapest

The state’s auto coverage is also considered to be among the most affordable in the country. Mary Taylor, the Ohio Lieutenant Governor and the director of the Department of Insurance, has recently announced that the auto and homeowners insurance premiums within the state are yet again some of the lowest in the country. In her statement, she said that the marketplace in the state continues to offer favorable premiums. Taylor explained that “Ohio’s competitive insurance market continues to provide consumers with choice and lower insurance premiums compared to the rest…

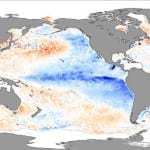

Read MoreHomeowners insurance rate increases blamed on climate change

The CEO of Travelers has said that severe weather patterns are the reason prices are rising. According to Jay Fishman, the CEO and chairman for The Travelers Cos. – one of the largest insurance companies in the country – has stated that the reason that the premiums for homeowners insurance have been steadily rising over the last three years has to do with the more extreme weather patterns that are the result of climate change. Insurers have come to accept that the weather is different now than it had once…

Read MoreHomeowners insurance in Florida set to increase despite lack of major storms

Despite the lack of natural disasters, it is still becoming more expensive to keep property coverage. Even though there was a striking lack in major catastrophes due to storms such as hurricanes, in 2012, the premiums associated with homeowners insurance policies in Florida are continuing to rise. The prices for some customers are increasing by a considerable amount across the sector. This trend is lead by the state backed homeowners insurance company of last resort, Citizens. This company has already had its premiums increase proposals approved, and other companies have…

Read MoreHomeowners insurance policyholders in Texas face highest premiums

Residents of the state are paying the largest amount for their coverage when compared to all other states. According to recently released data from the National Association of Insurance Commissioners (NAIC), residents of Texas are still paying the highest premiums for their homeowners insurance coverage. Though this remains the case, two other states on the Gulf Coast have rates that are nearly as high. In 2010, the average annual premiums paid by Texas homeowners insurance customers for the most commonly sold policy had been listed at $1,560. That amount was…

Read More