Allstate, the second-largest home insurance provider in the United States according to the Insurance Information Institute (Triple-I), is known for its comprehensive coverage for homeowners across the country since 1931. However, two insurance companies, including one owned by Allstate, are currently seeking approval for significant premium increases exceeding 50% for homeowners in Florida. Castle Key Indemnity Company Proposes a 53.5% Rate Increase Castle Key Indemnity Company, an Allstate subsidiary that provides insurance for condominium owners, has proposed a substantial rate hike of 53.5%. An Allstate spokesperson confirmed to WESH 2…

Read MoreTag: casualty insurance

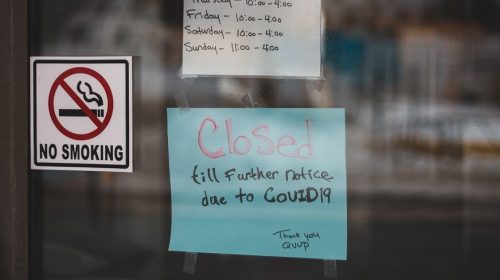

Insured pandemic losses for P/C won’t be accurately tallied for years, says Fitch

Property/casualty insurance companies recorded only modest loss increases in Q4 2020. According to Fitch Ratings, insured pandemic losses in the property/casualty sector rose only slightly in last year’s fourth quarter. That said, the final tally has yet to be calculated and, according to the US credit rating agency, it will be several years before it can be. Litigation is holding up the tally for business interruption, general and professional liability, and others. P/C insurers have managed to widely keep up capital strength since the pandemic started, said Fitch. Equally, pandemic-related…

Read MoreClimate change will be challenging for insurance companies, says Moody’s

A new report revealed the impact of warming climates worldwide on the insurance industry. The impact of climate change on the economy will have an increased liability risk for insurance companies. Catastrophes related to extreme weather are becoming more severe and frequent, according to a Moody’s Investors Service report. The report pointed to the rising instance of weather disasters like Hurricane Harvey in 2017. Moody’s Investors Service recently released a report. It investigated the economic aftermath of climate change. Insurance companies will face an increased liability risk from more frequent…

Read MoreWorldwide property and casualty insurance market to break $895 billion in 2018

Finnacord has now released the results of a research study looking into the future of the commercial P&C market. According to the outcomes of a research study conducted by the Finaccord financial research firm, by the close of the year 2018, the global commercial property and casualty insurance market will break the $895 billion mark in gross written premiums. It also pointed out that commercial liability coverage premiums would see the fastest growth rate. By the end of 2014, the worldwide commercial non-life premiums for property and casualty insurance were…

Read MoreGlobal commercial insurance rates dropped in Q2

Property coverage saw the largest drops during that quarter with more moderate decreases in casualty. Customers in the commercial insurance market saw positive news upon the release of a recent August 2015 report from Marsh, called the “Global Insurance Market Quarterly Briefing,” which determined that rates had decreased worldwide in nearly every business line. That report indicated that this was the ninth consecutive quarter in which there were decreases. It also explained that this trend of commercial insurance rate decreases is a reflection of the competition within the market. It…

Read More