Gen Z and Millennials know how important the coverage is, but they aren’t shopping to that degree.

According to a recent study, Gen Z and Millennials are well aware of the importance and benefit of having life insurance coverage, but they aren’t purchasing policies to a degree that reflects that understanding.

The research found that those generations are slightly less covered than the average of all adults.

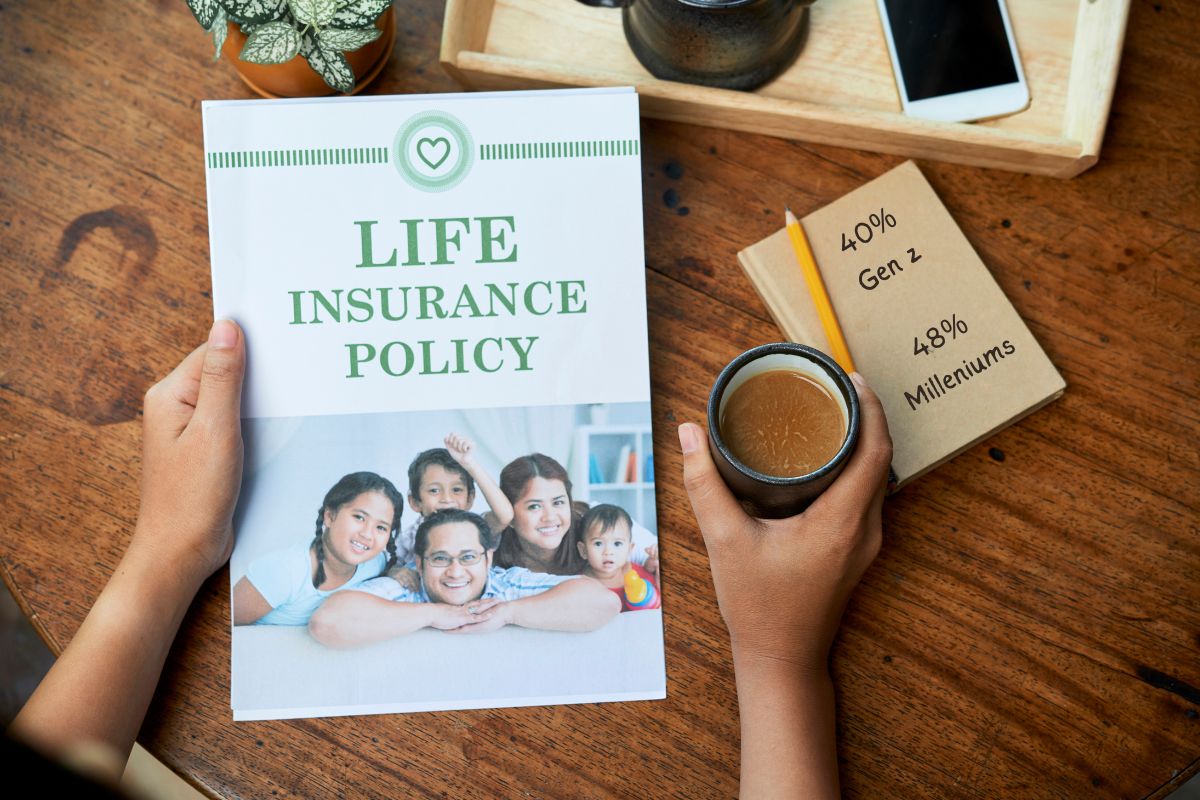

The research was conducted by Life Happens, an insurance education organization, which published its results in the 2023 Insurance Barometer Study. Life Happens worked with the LIMRA research organization. They found that across all adults of all generations, 52 percent owned life insurance. That said, they discovered that Gen Z and Millennials weren’t quite as covered as the average. About 40 percent of Gen Z and 48 percent of Millennials had a policy.

Still, just because they didn’t have coverage, it didn’t mean that they weren’t aware of the importance or benefits it had to offer. Among the Gen Z respondents in the research, 49 percent acknowledged the importance of having or boosting coverage. Among Millennials, this figure was 47 percent.

This led the researchers to ask why understanding life insurance wasn’t leading them to buy.

What they determined was that many people in these generations weren’t fully aware of what purchasing the coverage entailed, even if they knew how important it was. This was particularly true of the cost of the coverage.

According to the results of the research, about 55 percent of Gen Z adults and 38 percent of Millennials thought that a policy for a healthy thirty-year-old would cost at least $1,000 per year, when the true cost for such a person was closer to about $200 per year.

Insurers will therefore need to work to inform consumers in those generations about the affordability of coverage if they intend to change the trend and encourage life insurance purchases from those age groups. This education will be most important via social media, as it is the channel through which those generations obtain the majority of their information for everything from lifestyle decisions to financial knowledge.