Fitch Ratings has warned that new plans by the IAIS could make issues of certainty worse. According to a statement from Fitch Ratings, the intentions of the International Association of Insurance Supervisors (IAIS) to come up with a global coverage capital standard based on risk will only bring about another layer of uncertainty for the insurance industry. The goal of the IAIS is to have the standard created and fully in place by the year 2019. This was pointed out by Fitch Ratings in the statement that they recently issued,…

Read MoreTag: insurance industry risks

Insurance industry professionals must cope with regulation risks

A new study has revealed the largest risks faced by pros, the results of which have now been published in a report. New local and international level regulations are now being seen as the greatest risk faced by the insurance industry, according to a PricewaterhouseCoopers and Centre for the Study of Financial Innovation report. The new rules could considerably increase problems with compliance as well as costs for insurers. According to the 2013 Insurance Banana Skins Survey, new regulations regarding market conduct and solvency could “swamp” the insurance industry with…

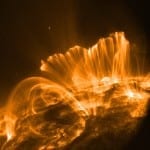

Read MoreLloyd’s estimates risks solar storms pose to insurance industry

Insurance industry may not be suited for powerful solar storms Lloyd’s of London has released a new report concerning the emerging risks associated with powerful solar storms. A solar storm is produced by solar flares and coronal mass ejections that are directed in the general location of the planet. Typically, such events present no significant threat to the world as they are relatively rare and not directly targeted at earth. According to Lloyd’s, however, a direct hit from such an event could have cataclysmic consequences, especially for the insurance industry.…

Read More