Insurance companies in Hawaii are reminding homeowners to ensure they’re covered. The Central Pacific Hurricane Season has begun, and Hawaii insurers are reminding homeowners to make sure they have adequate insurance coverage. The state insurance commissioner has also reminded owners and renters to review their policies. Reviewing a policy at least once per year to ensure that coverages and exclusions are appropriate for covering a homeowners property and possessions is highly recommended. Hawaii Insurance Commissioner Colin Hayashida has reminded state residents of the importance of this annual practice, particularly as…

Read MoreTag: property insurance

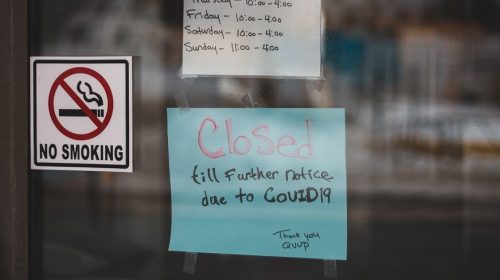

Insured pandemic losses for P/C won’t be accurately tallied for years, says Fitch

Property/casualty insurance companies recorded only modest loss increases in Q4 2020. According to Fitch Ratings, insured pandemic losses in the property/casualty sector rose only slightly in last year’s fourth quarter. That said, the final tally has yet to be calculated and, according to the US credit rating agency, it will be several years before it can be. Litigation is holding up the tally for business interruption, general and professional liability, and others. P/C insurers have managed to widely keep up capital strength since the pandemic started, said Fitch. Equally, pandemic-related…

Read MoreA homeowners insurance review is important at the start of every spring

Property coverage should be re-examined annually, and this season presents a good opportunity. Experts in the industry typically recommend that property owners conduct a homeowners insurance review once per year, and the spring is an ideal time to do it. The start of this season allows property owners to ensure they have adequate coverage for the year ahead. With the fresh starts that come with springtime, a homeowners insurance review can help policyholders to ensure that their coverage is still appropriate for their needs. This way, they can know that…

Read MoreTutoring business insurance isn’t required but may be necessary

Though private tutors aren’t legally required to buy coverage, the right policy may be essential. Tutoring business insurance may not have been the first thing that popped into your mind when you decided on this job, but it can make all the difference if things take an unexpected turn. When you decide to begin as a tutor, it’s a good idea to consider your risk exposure. Before you start working, think about the many types of risk that you may face along the way. As much as we may not…

Read MoreHome sharing participants need short term rental insurance coverage

Airbnb, VBRO and HomeAway members need special coverage for brief or seasonal rentals. Home sharing has become a popular way to earn extra income from a property, but all too many of those owners fail to obtain short term rental insurance. Regardless of whether a condo, seasonal property or home is rented in its entirety or just a portion, these guests are not typically covered by standard homeowners insurance. That said, this doesn’t mean that there isn’t any coverage at all for these helpful income sources. There are many home…

Read More