The total assets within that country for that sector rose by 22.3 percent last year. According to data from the China Insurance Regulatory Commission, the total assets of the insurance industry in the country rose last year by 22.3 percent. The assets in 2012 increased to the point that they reached $1.18 trillion. This is the equivalent to 7.36 trillian yuan worth of assets in the Chinese insurance industry. The achievement that has just been announced represents the first time that the sector in the country broke the CNY 7…

Read MoreTag: insurance industry report

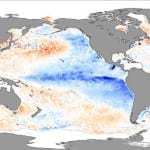

Insurance industry becoming a fierce opponent of climate change

Insurance industry continues to consider climate change a problem The insurance industry has long been attuned to the potential threat represented by climate change. For some insurers, climate change is not an issue of debate, as they are primarily concerned with the intensity and frequency of natural disasters. Over the past two years, the insurance industry has seen trillions in losses associated with uncharacteristically powerful natural disasters, such as Hurricane Sandy, which struck the U.S. in late November. Though climate change remains a volatile subject in the world of politics…

Read MoreThai floods: One year later

Lloyd’s of London analysts examine impact of Thai floods Just over a year ago, severe flooding in Thailand caused by a powerful and unforgiving monsoon season caused havoc in Bangkok and other cities throughout the country. Analysts from Lloyd’s of London have come together to examine the effects that the Thai floods had on the insurance industry and the country. The floods produced some $45.7 billion in damages, $12 billion of which was shouldered by insurance and reinsurance companies that operate in the country. Lloyd’s of London itself accounted for…

Read MoreInsurance-linked securities showing strong results

Aon reports insurance-linked securities performing well despite economic turmoil Aon Benfield Securities, the investment banking division of the global reinsurance organization, has launched the latest edition of its annual report on insurance-linked securities. Insurance-linked securities are financial instruments whose value is determined by insurance loss events. In its latest report, titled “Evolving Strength 2012,” Aon highlights a number of key trends it has observed over the past year. These trends range from the frequency and severity of natural disasters to the issuance of catastrophe bonds. Catastrophe bond issuance on the…

Read MoreInternational Insurance Review released by Globalsurance

First annual International Insurance Review report released Globalsurance, an international insurance information organization, has announced the results of its first International Insurance Review. The report, which is to be released annually, aims to study the rate of premium inflation within the international private medical insurance (iPMI) industry. The first edition of the International Insurance Review makes use of 7,916 data points provided by eight leading companies in the international medical insurance industry over the past 5 years. Using this data, Globalsurance has determined that insurance premiums around the world are…

Read MoreDisability insurance becomes more complex and expensive

Employee disability benefits, as is the case with virtually every other kind of workplace benefit, has become an expense that workers are beginning to need to pay for and manage – at least to some degree – themselves. Now that the 2012 open enrollment season has begun, an increasing number of employers are requesting that workers take on some of the financial burden for some of the more high-end forms of disability protection. Mercer benefits consultant partner, Rich Fuerstenberg, said that he has been witnessing a gradual trend toward workers…

Read MoreReport calls for more action from consumers to help mitigate the costs of natural disasters

This year has been host to a large number of natural disasters that have born a heavy price tag to the insurance industry. While natural disasters may not be happening more frequently, they are certainly happening in areas of dense population, making the damage they cause astronomical. Consumers often look to the insurance industry to provide protections against natural disasters, but the industry can only do so much. A new report from the University of Pennsylvania’s Wharton School suggests that government policy, as well as consumer initiative, may significantly reduce…

Read More