The insurer will use the technology to enhance its catastrophe claims and property inspections.

Farmers insurance recently announced its plans to launch a digitally controlled mobile insurance robot for assistance in completing in-field catastrophe claims as well as with non-catastrophe property inspections.

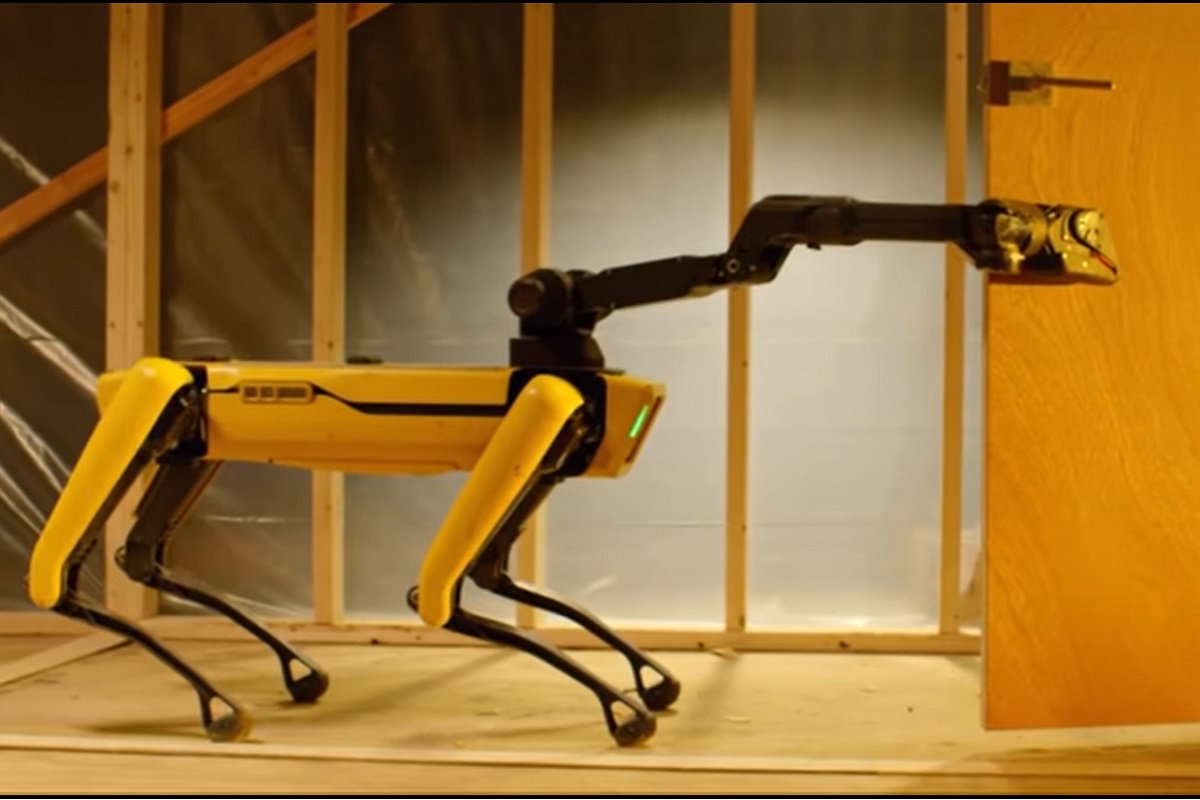

The technology, called Spot, is meant to help improve both safety and efficiency.

The insurer plans to use the insurance robot for improving the safety of non-catastrophe property inspections and in-field catastrophe claims, as well as to make those processes more efficient. This step also makes Farmers one of the first national Property and Casualty insurers to use a robotic quadruped to assist in the completion of those tasks.

The “Spot” robotic equipment was created by Boston Dynamics and customized for the needs of the insurer. Spot will be used by claims personnel starting as soon as fall 2021. It will be deployed to assist in the assessment of damage from catastrophes such as wildfires, earthquakes, hurricanes and tornadoes.

The insurance robot provides advanced mobility, agility and perception in difficult terrains.

With these additional capabilities, Spot can access environments and spaces that wouldn’t be accessible to human employees. It will be equipped with a number of different types of cameras and sensors to provide a detailed recording of what it “sees”. This will include a 360-degree camera as well as site documentation software. With these tools, it can reduce the amount of time an employee needs to spend capturing data and completing the review process while in the field.

Beyond those advantages, Spot may also be able to be used to assist claims adjusters in the collection of important data, as well as in assisting with claims handling optimization. That way, customers can be served with greater efficiency. On top of that, in the future Spot may one day also be deployed for handling non-catastrophic damage, such as in the case of collapsed structures, structure fires, water losses, and other environments that would be potentially hazardous to a person.

“Farmers focus on enhancing human-powered technology has led the organization to this very exciting milestone where we’re able to utilize new and emerging technology like a robot to further strengthen our commitment to our customers, all while helping to keep our employees safe,” explained Samantha Santiago, the insurer’s Head of Claims Strategy and Automation in a statement about the insurance robot. “Adding such a dynamic robot to our stock of evolving tech – such as drones and satellite imagery – will help us build on our legacy and deepen our commitment to customers.”