New Jersey victims file suit against insurers in wake of Hurricane Sandy Hurricane Sandy continues to cause problems along the East Coast. Though the storm is long over, its effects can still be felt in numerous states. Insurers may soon feel another financial impact as a result of the storm, but it will be coming from consumers instead of the storm itself. Hurricane Sandy victims from New Jersey have filed a class-action lawsuit against nine insurance companies. The suit claims that these insurers denied claims through the misinterpretation of something…

Read MoreAuthor: Nordstrom

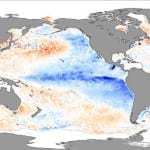

Insurance industry becoming a fierce opponent of climate change

Insurance industry continues to consider climate change a problem The insurance industry has long been attuned to the potential threat represented by climate change. For some insurers, climate change is not an issue of debate, as they are primarily concerned with the intensity and frequency of natural disasters. Over the past two years, the insurance industry has seen trillions in losses associated with uncharacteristically powerful natural disasters, such as Hurricane Sandy, which struck the U.S. in late November. Though climate change remains a volatile subject in the world of politics…

Read MoreIndia’s RSBY program taking advantage of consumers

RSBY program subject to World Health Organization study India may be home to a robust health insurance market, but its consumers may be falling victim to exploitation, according to a new study sponsored by the World Health Organization. The study focuses on the Rashtriya Swasthya Bima Yojana (RSBY) program, which is a health insurance initiative sponsored by the Indian government. The RSBY program is designed to provide poor citizens with access to health insurance policies that are affordable, yet comprehensive. Consumers may actually be paying much more for this insurance…

Read MoreT-Mobile may be raising insurance rates

T-Mobile could be pushing higher insurance rates next year Insurance coverage for mobile devices is becoming increasingly common and more comprehensive, especially as more consumers come to rely on their mobile devices in their daily lives. Smart phones represent a significantly costly investment for a wide range of people and are well-loved by many because of the features they offer. Smart phones are also popular targets of theft because of the information they contain and some are notoriously fragile. T-Mobile customers may see the insurance rates for their mobile devices…

Read MoreConnecticut moves forward with health insurance exchange

Connecticut aims to have exchange operational ahead of deadline Connecticut is one of the few states in the U.S. that has made significant progress in establishing its own health insurance exchange. The state is keen to operate the exchange itself in the hopes of providing service to residents that is suited to the needs of the market. Though the state has made major progress over the past two years to build its own exchange program, the Legislature is now working to make the program a reality, hoping to beat the…

Read More