Floridians are placing themselves at risk in the event that they face a natural disaster. As the cost of home insurance continues to increase tremendously in Florida, there is a growing number of property owners choosing not to continue to pay for coverage or who decide that they can no longer afford it. Florida residents without a mortgage have the choice Floridians who still have a mortgage are required to keep their home insurance as a part of their loan agreement. That said, those who own their homes outright can…

Read MoreCategory: Financial News

The financial insurance news being updated every day will keep investors as well as professional abreast to industry and the many changes that are occurring in today’s business world.

North Carolina Commissioner rejects proposal to increase insurance rates

Drivers and property owners are reducing their coverage to afford their premiums North Carolina Commissioner Mike Causey has announced that he recently turned down a request made by insurers to boost homeowners’ insurance rates by an average of 42.2 percent. In some beach areas, the hike would have been 99.4 percent According to Causey, he was not provided with adequate evidence to support the claim insurers made that they would need to increase insurance rates by that amount. “I haven’t seen the evidence to justify such a drastic rate increase…

Read MoreState Farm insurance company loses $6.3 billion in 2023

The insurer experienced a “significant” increase in catastrophic claims leading to the losses Last year, State Farm insurance company recorded a $6.3 billion net loss partially due to what the insurer called a “significant” rise in home insurance damage claim severity. As large as the loss was, it was smaller than what the insurer experienced in 2022 In 2022, the insurance company reported having lost a net $6.7 billion. Still, when State Farm made its announcement about 2023, it confirmed that it was “financially strong”, as its auto coverage’s net…

Read MoreState Farm Registers $6.3 Billion Net Loss in Challenging 2023 Fiscal Year

Despite attempts to improve results following a substantial $6.7 billion loss in 2022, State Farm, a leading insurance giant, ended 2023 with a $6.3 billion net loss. The company cites a surge in catastrophe claims as a significant factor contributing to their financial results. Elevated Claims and Unfavorable Results The Financial Climate State Farm’s financial report for the year reflects a tumultuous period, as total revenue reached $104.2 billion, yet it was not enough to prevent a net loss. The company’s combined ratio, a key measure of underwriting profitability, rose…

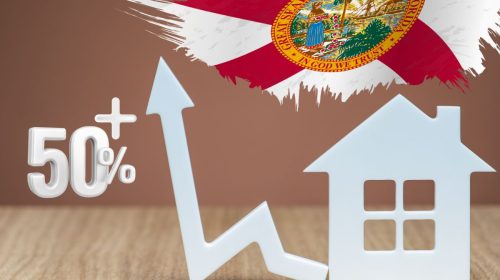

Read More2 Florida home insurance companies aim to raise rates more than 50%

Amica Mutual Insurance and Castle Key Indemnity have requested the increases in the state Home insurance rate hikes are nothing new to Florida property owners, but a recent request made by two private insurers in the state aims to increase rates by over 50 percent. Increases at that level are high even for Florida Amica Mutual Insurance and Castle Key Indemnity have formally requested to raise their rates by more than 50 percent for policies covering condominiums and secondary residences. According to the companies, the increases are required to help…

Read More