State Farm’s hurricane deductibles spur request from state’s Insurance Commissioner State Farm has announced that it has begun reviewing a request from Louisiana Insurance Commissioner Jim Donleon regarding homeowners insurance. The Commissioner has issued a request to the insurer concerning the offering of a second deductible option for hurricanes. Commissioner Donelon notes that hurricane deductibles have become common in coastal states, where hurricanes are somewhat frequent. State Farm recently introduced a 5% deductible for its homeowners insurance policies in Louisiana. Deductible has attracted controversy from homeowners The deductible is meant…

Read MoreTag: natural disasters

Insurance industry is beginning to respond to evolving global market

Insurers and reinsurers are adopting a new approach to their markets Insurance and reinsurance companies are beginning to re-evaluate their business models as prices begin to soften throughout the global market. Risks are beginning to evolve and new investors are beginning to power changes within the commercial insurance market. These changes are encouraging companies to change the way they approach their chosen market sectors in order to better accommodate demand and ensure their continued sustainability. Companies are also feeling a greater need to balance their exposure to certain risks, especially…

Read MoreConsumers begin pulling out of South Carolina homeowners insurance program

Insurance program is experiencing an exodus of policyholders Homeowners are beginning to pull out of South Carolina’s wind pool insurance program. The program exists as a last-resort option for those seeking insurance coverage in the state. The program is primary meant to provide coverage to properties that exists along the state’s coastlines, where wind damage is somewhat common. Many insurance companies in the private market do not offer wind protection alongside their homeowners insurance policies, which has made the state’s insurance program relatively popular, until very recently. Population of state’s…

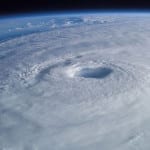

Read MoreFlood insurance enters the limelight as hurricane season begins

Hurricane season is bringing more attention to flood protection The 2014 Atlantic hurricane season has started, and weather forecasters are predicting that this season may be quite active, but the storms emerging during the season may be modest due to the effects of El Nino. There is no certain way to tell whether or not the hurricane season will be free of any powerful storms, as 2012’s Hurricane Sandy was quite unexpected itself. The impact of an unexpected storm can be devastating, which is why there is a growing interest…

Read MoreThe Insurance Industry and Climate Change

Insurers are taking steps to address climate change When it comes to climate change, insurance can be a tricky subject. The global insurance industry does not typically deal in “what ifs” and many large insurers are not willing to debate whether or not climate change is real. These insurers are more apt to address the issue of climate change by offering new insurance products and finding ways to mitigate the risks associated with the phenomenon. Powerful storms, rising temperatures, and depleting food and water resources are becoming issues that the…

Read More