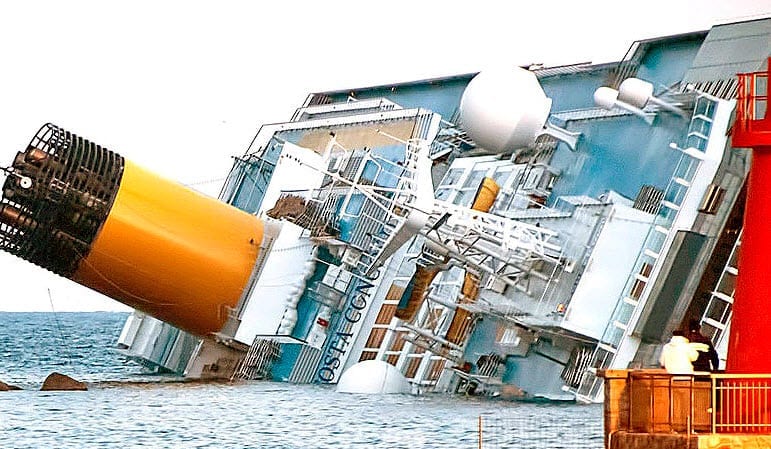

When booking a vacation, many people wonder whether or not it is truly worth the added expense to purchase a travel insurance package, and whether or not it will cover them in case of a disaster such as what occurred on the Costa Concordia.

When booking a vacation, many people wonder whether or not it is truly worth the added expense to purchase a travel insurance package, and whether or not it will cover them in case of a disaster such as what occurred on the Costa Concordia.

Cruise passengers did indeed benefit from their protection when they were evacuated from the ship. While they waited for Costa Cruise Lines to provide their assistance, those who had purchased travel insurance were already served by the insurers who relayed messages back to the loved ones of the travelers, replaced identification documents (as many of the passports were left behind on the ship) and quickly arranged flights for the passengers to return home again.

The most common policy sold for vacationers on that trip cost about 5 to 7 percent of the total vacation cost. Its coverage included trip interruption and cancellation, as well as emergency evacuation, medical expenses, and baggage protection.

The covered passengers on the Costa Concordia were reimbursed for any of the emergency medical evacuation and medical expenses that they faced. Their policies also included $10,000 for accidental death and dismemberment coverage.

Some of the people who were evacuated from the ship will also likely make claims for their baggage protection benefits in order to be reimbursed for their lost personal items. That said, Carnival Corp., the parent company of Costa Cruise Lines, will also be “addressing personal possessions lost on board.,” according to a statement they released.

It is clear that regardless of any compensation that will be provided by the cruise line, those passengers who insured themselves before leaving on their vacations were provided with peace of mind and assistance that made it much easier to cope with the disaster.