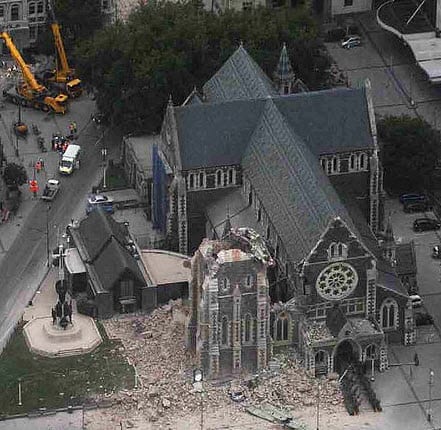

As the rebuilding of Christchurch, New Zealand, continues months after a disastrous earthquake struck the nation, insurance companies are going to have a hard time finding reinsurance deals as prices are set to triple by July 1st, according to S&P’s analysts.

As the rebuilding of Christchurch, New Zealand, continues months after a disastrous earthquake struck the nation, insurance companies are going to have a hard time finding reinsurance deals as prices are set to triple by July 1st, according to S&P’s analysts.

The rise in reinsurance rates is due to the extent of the damage done in New Zealand by the initial quake and its subsequent aftershocks, which are still occurring today. As the aftershocks continue, so too does the damage worsen, driving reinsurers to raise their rates in an effort to reclaim their material losses.

Michael Vine, a credit analyst with S&P, says that the reinsurance industry is fully capable of providing policies at will, but most are unwilling to do so without a significant rate increase. This does not bode well for many insurance companies operating in New Zealand as most are joint ventures which have ties in Australia, another country suffering from the repercussions of severe natural disasters. The negotiating power lies firmly in the hands of the reinsurance industry, says Vine.

Initial estimates from S&P, as well as many other risk modeling and financial analysis firms, suggested that the inflation of reinsurance prices would be modest. However, these estimates were issued shortly after the February 22nd quake and have since been regularly revised to show ramping costs. Now, the lowest increase coming from the reinsurance industry in New Zealand is set at 50%.

Despite the continual problems wracking the country, few insurers have fled New Zealand. The perseverance of these companies, according to S&P, may contribute to a healthier, more robust insurance market in the future.