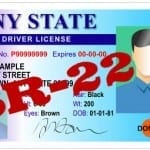

If you are a habitual traffic offender… Get a DUI or otherwise present a high-risk as a driver, you may very well have to obtain SR22 car insurance. SR22 insurance is not actually an insurance policy, but rather, a document that is filed with the Department of Motor Vehicles that shows you do have car insurance. There are many misconceptions about what SR22 auto insurance is and what it is not. You may see television commercials promising cheap SR22 insurance and they can be misleading. Following are 5 myths surrounding…

Read MoreTuesday, February 27, 2024

Recent posts