Munich Re predicts that the strength of the sector will continue on over the next 7 years. According to the Insurance Market Outlook 2013, which was just released by Munich Re, the global insurance industry will continue with strong growth over several years to come, especially in emerging nations. The report showed that there will be slower growth in reinsurance than in the primary coverage sector. The chief economist at Munich Re, Michael Menhart, said about the insurance industry’s future, that “The global economic recovery is also benefiting the insurance…

Read MoreTag: insurance industry report

Insurance industry shows praise for Accenture technology

Accenture receives high rating for the technology it provides to the insurance industry Accenture, a global management consulting and technology services company, has received the highest possible rating from Gartner, a global market research firm, for the fifth consecutive year. Gartner has released the results of its “MarketScope for North American Property and Casualty Insurance Claims Management Modules” report, wherein Accenture’s Claim Components software won top marks from the firm. The software has proven valuable for much of the insurance industry in the U.S., especially as the interests of insurers…

Read MoreInsurance industry in China broke $1.18 trillion last year

The total assets within that country for that sector rose by 22.3 percent last year. According to data from the China Insurance Regulatory Commission, the total assets of the insurance industry in the country rose last year by 22.3 percent. The assets in 2012 increased to the point that they reached $1.18 trillion. This is the equivalent to 7.36 trillian yuan worth of assets in the Chinese insurance industry. The achievement that has just been announced represents the first time that the sector in the country broke the CNY 7…

Read MoreInsurance industry becoming a fierce opponent of climate change

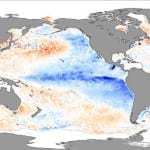

Insurance industry continues to consider climate change a problem The insurance industry has long been attuned to the potential threat represented by climate change. For some insurers, climate change is not an issue of debate, as they are primarily concerned with the intensity and frequency of natural disasters. Over the past two years, the insurance industry has seen trillions in losses associated with uncharacteristically powerful natural disasters, such as Hurricane Sandy, which struck the U.S. in late November. Though climate change remains a volatile subject in the world of politics…

Read MoreThai floods: One year later

Lloyd’s of London analysts examine impact of Thai floods Just over a year ago, severe flooding in Thailand caused by a powerful and unforgiving monsoon season caused havoc in Bangkok and other cities throughout the country. Analysts from Lloyd’s of London have come together to examine the effects that the Thai floods had on the insurance industry and the country. The floods produced some $45.7 billion in damages, $12 billion of which was shouldered by insurance and reinsurance companies that operate in the country. Lloyd’s of London itself accounted for…

Read More