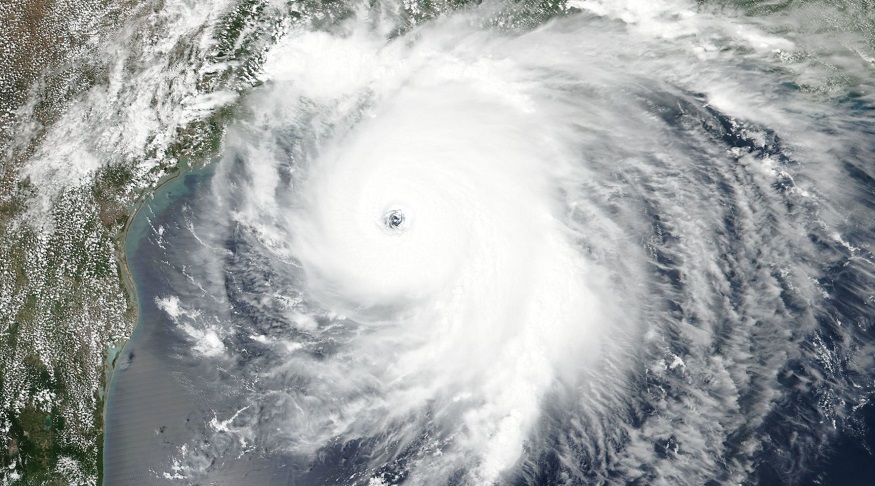

Many property owners aren’t taking into consideration the additional challenges from COVID-19. Even after the devastation left behind by the major storms last week, most homeowners feel they have made adequate hurricane preparedness efforts, according to a recent survey. When Hurricane Laura reached the US Gulf Coast, it struck as a highly powerful category 4. According to the research conducted by ValuePenguin, most homeowners – 86 percent – feel that the hurricane preparedness steps they have taken are enough. However, thousands of people who were in the path of last…

Read MoreTag: hurricane insurance

Hurricane Dorian gives Americans a wake-up call they should not ignore, says Allstate

The insurer’s data shows that almost 60 percent of U.S. residents aren’t prepared for a natural disaster. Well over half of all Americans would have been completely unprepared for an event like Hurricane Dorian, said a recent report released by Allstate Insurance. Nearly 60 percent of Americans are assuming that natural disasters won’t affect them. Allstate Insurance used Hurricane Dorian as an example of the type of natural disaster that can threaten Americans. Its report showed that while 70 percent of Americans say that they are concerned over catastrophic events…

Read MoreConsumers seek hurricane travel insurance coverage for their vacations this season

After a few years of activity during the Atlantic storm season, travelers are looking into their options. The last few years have come with active Atlantic storm season, encouraging travelers this year to look into hurricane travel insurance coverage. Travelers are looking into the types of policy available and how much it will cost. The hurricane season runs from June through November every year. While some seasons see barely any storm activity at all, others are highly active. This year has already seen storms and Barry managed to make landfall…

Read MoreCitizens Insurance is still battling thousands of Hurricane Irma lawsuits

The Florida insurer of last resort is still grappling with legal challenges from two years ago. Florida Governor Ron DeSantis and state lawmakers recently approved a Citizens Insurance overhaul plan. The overhaul redesigned the controversial “assignment of benefits” practice. It also added new restrictions regarding lawsuits that can be filed against insurance companies. The state-backed insurance company will still need to deal with its thousands of existing lawsuits. Citizens Insurance is still attempting to work its way through thousands of existing lawsuits. These were filed well before the overhaul was…

Read MoreNational Flood Insurance Program Gets Brief Renewal from Congress

The House of Representatives gained a two week extension for the federal flood insurance. Congress extended the National Flood Insurance Program (NFIP) by two weeks after it failed to pass a $19 billion disaster aid bill. The House of Representatives was seeking unanimous consent for the bill which contained a flood insurance reauthorization provision. NFIP had been set to expire as of Friday, but the two week extension was granted in time. With less than six hours left before the National Flood Insurance Program, the fast-track unanimous consent vote approved…

Read More