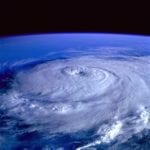

Following the devastation Hurricane Matthew left behind on the east coast, insurers are now responding to claims. Hurricane insurance companies are now responding to the thousands of claims they received as a result of Hurricane Matthew. These property damage claims occurred when the storm slammed its way across the bottom portion of the East Coast. Hurricane Matthew left its mark on states along the coast from Florida right through to Virginia. Damage was extensive in central Florida. That said, it wasn’t nearly as great as predictions had suggested. The area…

Read MoreTag: hurricane damage

Hurricane Matthew insurance losses may not be as bad as expected

Early predictions estimated that insured costs could reach $25 billion to $30 billion from the storm. Early industry estimates had suggested that Hurricane Matthew insurance losses may be the second highest the country has ever seen. This storm represented the first direct hit the United States has experienced from a hurricane in over ten years. It is still too early to know the total cost of the damage it caused. Estimates had said it could be as high as $25 billion to $30 billion. This would make the storm the…

Read MoreMexico insurance industry expected to handle the impact of Hurricane Patricia

A.M. Best provides some insight into Mexico’s insurance industry A.M. Best, a rating agency based in the United States, has issued a comment concerning Mexico’s insurance industry and how it may be impacted by Hurricane Patricia. The powerful storm formed alarmingly quickly in the Pacific ocean and was the strongest hurricane ever recorded, with sustained winds recorded in excess of 200 miles-per-hour. While the storm dissipated quickly once making landfall, there are still serious concerns regarding flooding and the damage that heavy rainfall has caused. Insurers are expected to be…

Read MoreAIR Worldwide Updates Estimates of Insured Value of U.S. Coastal Properties

BOSTON, June 3, 2013 – Catastrophe modeling firm AIR Worldwide has released an update to its “The Coastline at Risk” report. The update presents and discusses AIR’s most recent estimates of the insured value of residential and commercial properties in states along the Eastern Seaboard and Gulf Coast of the United States. While above-average sea surface temperatures in the last nearly two decades have elevated hurricane activity in the open Atlantic, there is a far more certain driver of U.S. hurricane risk that the insurance industry faces. It is the…

Read MoreInsurance news from Canada shows $100 million in claims from Sandy

After the superstorm pummeled through the United States, it smashed into Canadian provinces. According to the most recent insurance news estimates from Canada, after leaving the United States, superstorm Sandy led to insured property damage that will total approximately $100 million. These statistics were issued from the Insurance Bureau of Canada (IBC) based on claims received. The IBC has based this data on the claims that are being made in the Canadian provinces of Ontario and Quebec. The estimate is still considered to be preliminary, but it has now been…

Read More