While the COVID-19 crisis rages on, and insurers face challenges, some are thriving. The Canadian insurance industry has measured some pockets of growth in specific areas of coverage throughout the pandemic crisis. Insurers are struggling in the areas of coverage disagreements, particularly in business interruption policies. Business interruption and travel policies are often leading to disputes over coverage, lawsuits, angry clients and customers, and economic challenges among others. However, in other areas, some considerable opportunities have opened up for certain types of product lines to grow and developed. Among those…

Read MoreTag: COVID-19 crisis

Nationwide starts July as fully independent insurance agency carrier

The company has completed its transition which has been ongoing over the last 18 months. Nationwide has announced that as of July 1, it has become an independent insurance agency carrier. The Columbus, Ohio-based insurer has kept its relationships with 99 percent of its formerly captive agents. For 18 months, the insurer has been working on the transition process to become an independent insurance agency carrier. Throughout that time, it has managed to keep over 99 percent of its agents, who were formerly employed by the company. Now, those insurance…

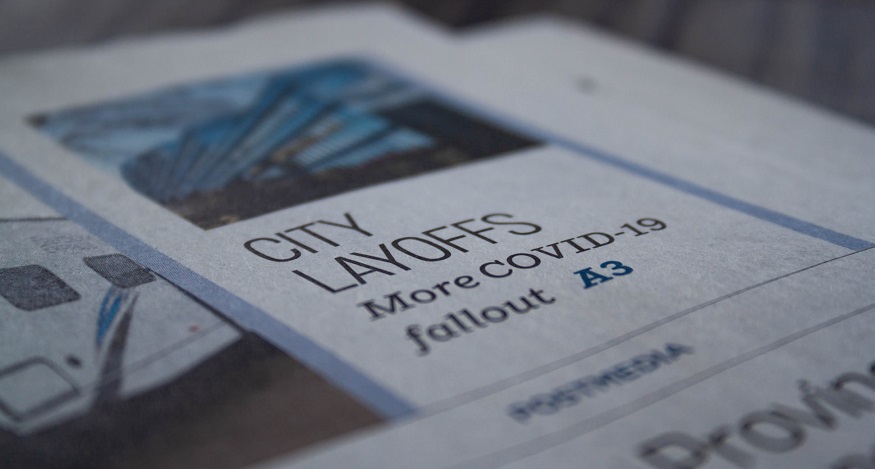

Read MoreAllstate faces “thousands” of insurance job layoffs for its staff

The insurer intends to let thousands of people go in an effort to reduce its costs, say reports. Allstate Corporation plans to use thousands of insurance job layoffs to try to cut costs, say several reports. The news came directly from the insurer’s CEO who discussed it in a recent video conference call. Allstate CEO Tom Wilson held a video conference call with his senior team leaders. In that call, he talked about the fact that thousands of insurance job layoffs were on their way. These “thousands of jobs” would…

Read MoreProgressive auto insurance premium growth slows due to COVID-19 crisis

The pandemic hasn’t stopped the insurer from seeing a rise in its profitability. The short-term impact from the pandemic on Progressive auto insurance may turn out to be a rise in underwriting profitability while premium growth shrinks. S&P Global Market Intelligence conducted a monthly earnings report analysis on the insurer. The analysis revealed that Progressive auto insurance saw improvement in its personal vehicle combined ratio, but at the same time its premium growth was applying the brakes. That impact was recorded on both the month-to-month and year-over-year data for March…

Read More