Even as rates have started dropping, it is unlikely that drivers will see their premiums easing. Though drivers might be inclined to believe that as inflation starts to fall, auto insurance rates aren’t likely to get any cheaper. In fact, premiums are expected to rise, and in some areas, they’ll be increasing by quite a bit. The average cost of full coverage is $2,014 in the United States, which is 14 percent higher than last year. According to the True Cost of Auto Insurance Report by Bankrate, the average cost…

Read MoreTag: car insurance premiums

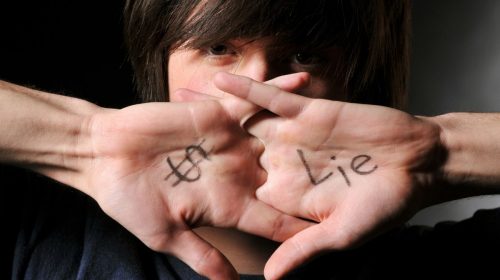

Lying on car insurance applications is common in the hopes of saving money

Research shows that Americans regularly lie on the details they submit to their insurers. Americans will often lie on their car insurance applications in the hopes of saving money, according to a Finder.com study. The data from the study showed that 35.8 million Americans fudge their details to get lower rates. The study determined that the 35.8 million people across the country lie on their applications to try to lower the car insurance premiums they must pay. Moreover, the number is considerably higher than what it was in 2020, when…

Read MoreState Farm teams up with Ford for usage-based insurance

The Drive Safe & Save Connected Car program will use telematics tech to adjust premiums. State Farm and Ford have announced that they have jointly launched a usage based insurance (UBI) program for drivers called the Drive Safe & Save Connected Car. The UBI program is available to drivers of connected Ford or Lincoln vehicles. State Farm customers driving the eligible connected Ford vehicles can choose to opt in for usage based insurance. The UBI program uses telematics to adjust premiums to reflect that vehicle’s mileage and its drivers’ unique…

Read MoreTask force takes on Louisiana auto insurance rates to improve affordability

Research shows that drivers in the state pay some of the highest car insurance premiums in the country. Louisiana auto insurance rates are among the least affordable in the United States, according to a recent Insurance Research Council (IRC) study. The study was titled: “Auto Insurance Affordability: Cost Drivers in Louisiana”. That said, the Louisiana High Auto Rates Task Force has been working on the challenge of improving affordability since August. The task force has met several times to address the causal factors and propose solutions to the issues. The…

Read MoreAllstate auto insurance rates are going up for Illinois drivers

The insurer has increased premiums in the state by an average of 6 percent, following a statewide trend. Allstate auto insurance customers are about to face an increase in the rates they’re paying for their policies. This announcement was made only 6 months after a similar one was made State Farm, the largest car insurance company in the state. The average increase for drivers in the state with Allstate coverage will be about 6 percent. The original filing to increase Allstate auto insurance rates was made in January. An Illinois…

Read More