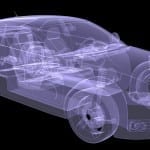

The automotive landscape is embarking on a transformative journey with electric vehicles (EVs) and high-tech cars steering the course. This electrifying shift is not only redefining transportation but also reshaping the dynamics of auto insurance. As EVs and vehicles laden with cutting-edge technologies become more prevalent, their impact on insurance costs has emerged as a critical issue for drivers and insurers alike. The fusion of sophisticated electrical systems, driver-assist technology, and complex vehicle software has ushered in a new era of challenges in risk assessment and repair costs. Understanding these…

Read MoreTag: auto insurance technology

Usage based insurance devices track drivers using GPS

This type of program may be causing motorists to exchange their privacy for potential discounts. Drivers who are looking to save money on their auto premiums are starting to look toward options such as usage based insurance, which involves installing a device in the motorist’s vehicle in order to allow the insurer to track actual driving habits, instead of basing premiums exclusively on more general risk models. While this can give safe drivers the chance to prove their low risk, and save money, there may be a catch. Privacy advocates…

Read MoreUsage based insurance is not appealing to most Americans

A recent study has shown that over half of the drivers in the country aren’t sold on having their habits monitored. The results of a study conducted on the popularity of usage based insurance, also known as a pay as you drive plan, have recently been released, and they have shown that 51 percent of Americans will not even consider enrolling in this type of program. The majority of consumers are resistant to being monitored in order to be able to obtain possible discounts. The results of the study that…

Read MoreInsurance technology could place US drivers at risk, says hacker

Tech expert, Corey Thuen, will be speaking at the S4 conference to show that pay as you drive dongles aren’t secure. Corey Thuen is a Digital Bond Labs security researcher, who has been working for a number of weeks on the subject of the insurance technology of onboard network dongles that are connected to the OBD2 ports of vehicles as a component of usage based auto policies. The findings of the research have been striking and they will soon be presented in a talk entitled “Remote Control Automobiles”. Thuen looked…

Read MoreUsage based technology may become mandatory in auto insurance

These wireless device based “pay as you drive” policies are rapidly evolving and are becoming more popular. Usage based technology is becoming increasingly popular in auto insurance, as a growing number of insurers start to offer policies that use these wireless telematics devices and a larger number of motorists sign up for these programs in the hopes of qualifying for lower rates. Many are now predicting that in ten years from now, these policies will be the norm. In fact, some have forecasted that usage based technology will become nearly…

Read More