The state has reached a crisis point in its property coverage market with prices headed steadily skyward. Families affected by the hurricanes that have hit the state in many years have already been facing rapidly climbing home insurance rates, but at the same time, they’re also battling with insurers to pay for the costs they’ve paid to make their homes livable again. Insurers in the state have gone bankrupt, leaving policyholders floundering While settlements from some home insurance companies are protected through the state-backed guaranty association, the process can take…

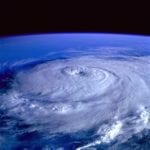

Read MoreTag: Atlantic hurricane season

Farmers Insurance Group stops selling new Florida homeowners’ policies

The insurer announced that it is no longer writing new policies just as the hurricane season started. The Atlantic Hurricane Season has only just started this month, but along with it has come the announcement that Farmers Insurance Group has decided to stop selling property policies in the state. The insurer’s existing customers will still be able to keep their coverage, but new policies won’t be sold. At this time of year, many homeowners are taking the time for a last moment scramble to make sure they have the coverage…

Read MoreMost residents of high-risk flood zones don’t have flooding insurance, analysis

A recent study has shown that an average of 6 in 10 affected homeowners aren’t covered. Severe weather events don’t plan to take a break just because of the COVID-19 pandemic, but a new analysis shows that 6 in 10 homeowners in high-risk flood zones don’t have insurance against overland water damage. The Atlantic hurricane season starts today, and severe flooding has already started in some areas. Central Michigan, for instance, has already been affected by considerable flooding in many regions. ValuePenguin.com recently published the results of an analysis it…

Read MoreCost of hurricanes to insurance industry will break $100 billion, JPMorgan

Insurers face massive bills from the three hurricane-level storms that made U.S. landfall, even before Nate. Though it’s too early to know the insured damage total of Hurricane Nate, the cost of hurricanes to insurance industry coverage providers in the United States will already reach $100 billion, says JPMorgan. This prediction aligns with other industry players, such as Fitch Ratings. The catastrophe left behind by Harvey, Irma and Maria will be a hard hit to insurance company earnings. At the same time, it’s likely that the cost of hurricanes to…

Read MoreHurricane insurance companies are preparing for a busier season than usual

As Harvey makes its way closer to Texas, insurers are bracing for the impact of landfall. Forecasters and hurricane insurance companies alike are watching both Harvey and the rest of the Atlantic storms that are brewing. The season is expected to be more active than average and it is far from over. In fact, the Atlantic hurricane season has only just reached its peak and will continue until November. Many meteorologists and weather monitoring organizations have upgraded their initial forecasts for the season. Though it was originally expected to be…

Read More