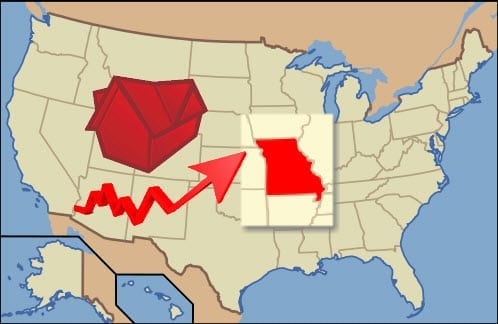

The past month has been trying for residents of Missouri. Storms late in April sent the Mississippi River on a rampage. Miles of farmland were inundated with water, causing billions in damage and displacing the state’s farmers. Those same storms were accompanied by an outbreak of tornados that tore through much of the region. The now infamous Joplin tornado – the most deadly and destructive tornado in six decades – that sundered a town and left hundreds without homes was the last of the environmental onslaught. Together, these disasters will have an impact on the state’s economy that will resound through the ages.

The past month has been trying for residents of Missouri. Storms late in April sent the Mississippi River on a rampage. Miles of farmland were inundated with water, causing billions in damage and displacing the state’s farmers. Those same storms were accompanied by an outbreak of tornados that tore through much of the region. The now infamous Joplin tornado – the most deadly and destructive tornado in six decades – that sundered a town and left hundreds without homes was the last of the environmental onslaught. Together, these disasters will have an impact on the state’s economy that will resound through the ages.

The state’s insurance industry has done all it can to aid in the aftermath of these calamities, but many insurers will have to take steps in recovering from their losses. To this end, several have submitted proposals for rate increases to be reviewed by regulators. Alone, the tornado that struck Joplin is estimated to cost insurers more than $3 billion, a fact that will not go unnoticed by residents who worry that insurance rates will soar to new heights.

Tradition dictates that insurance premiums spike after an area has been hit by some catastrophe. However, Brent Butler, government affairs director for the Missouri Insurance Coalition, believes that there is a silver lining in the wake of these disasters.

“These events could have an effect on everybody’s insurance rates eventually,” says Butler. “That is eventually, and I wouldn’t call it dramatic.”

April’s storms had struck a wide area causing widespread damage. Butler believes that because of the scope, more people are likely to see higher rates. “Because so many people will be paying more, maybe it won’t be so much overall.”

Furthermore, Butler is sure that the state’s economy will recover quickly as there will be a higher demand for construction crews to rebuild the damaged parts of Joplin.