LIMRA has reported that 70 percent of people in the U.S. don’t understand the coverage.

LIMRA has reported that 70 percent of people in the U.S. don’t understand the coverage.

In the United States, ownership of life insurance has reached a historical low and a recent LIMRA study has suggested that it is likely because Americans don’t understand why it is needed or how the products in that sector actually work.

The global consulting and research organization determined that there is a lack of understanding and knowledge.

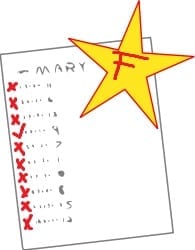

In order to come up with this claim, LIMRA applied a type of IQ test for life insurance to 4,000 American participants. This was designed to help to measure the overall comprehension and understanding that these individuals held about this coverage. What they discovered was that the respondents had a strikingly low knowledge regarding this type of policy.

There were ten total questions that had to be answered by the participants in the life insurance IQ test.

What LIMRA found was that among the 4,000 respondents, less than one third were able to pass the life insurance test with a “grade” of 55 percent or higher. Over 70 percent answered fewer than five questions correctly. Moreover, among all of the participants, less than one percent were able to give the right answer for all of the ten questions.

The organization found that the respondents that had the highest life insurance IQ test scores had the following in common:

• Were able to cite a number of different information sources that are responsible for their understanding of the coverage;

• Own their own life insurance policy;

• Have a primary source of income that is either through their employment as a financial or seminar planner of some kind;

• Are in an older age bracket;

• Have large degree of life insurance industry confidence;

• Have a high education level;

• Are highly interested in the investable assets of their households;

• Are male;

• Feel that life insurance is important.

The study made an important and defining statement for this sector of the industry by saying “One of the top reasons consumers give about why they don’t buy life insurance is because it is ‘too confusing.’”