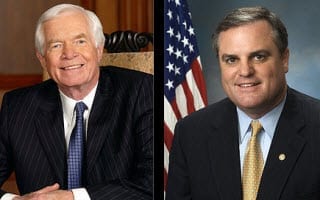

Two legislators are looking to reverse federal flood-insurance mandates requiring property owners in areas protected by flood-control structures to have flood insurance. Senators Thad Cochran of Mississippi and Mark Pryor of Arkansas say that the mandate presents an undue financial burden to those living in areas that are not prone to floods due to the protective measures taken against such a happening. The legislation in question is part of the National Flood Insurance Program, which itself is the subject of much debate in Congress due to its financial instability.

Two legislators are looking to reverse federal flood-insurance mandates requiring property owners in areas protected by flood-control structures to have flood insurance. Senators Thad Cochran of Mississippi and Mark Pryor of Arkansas say that the mandate presents an undue financial burden to those living in areas that are not prone to floods due to the protective measures taken against such a happening. The legislation in question is part of the National Flood Insurance Program, which itself is the subject of much debate in Congress due to its financial instability.

The senators are working to have the issue included in the Flood Insurance Reform Act, which is a new legislation introduced this year to make changes to federal regulations concerning flood insurance. The act would make sweeping changes to NFIP and legislators have until November 18 to pass the measure or the federal program will collapse.

While Cochran and Pryor are looking to have the requirements for insurance abolished on areas protected by levees and dams, the pair is willing to compromise on the issue depending on the fate of NFIP. If these areas are afforded the lowest premiums offered by the program, the Senators believe that the financial burden would be lessened and that consumers would enjoy at least a little more financial breathing room in a troubling economy. According to Cochran, the mandates should be changed to ensure fair treatment for protected properties.