Berkshire Hathaway investors are looking toward a positive future.

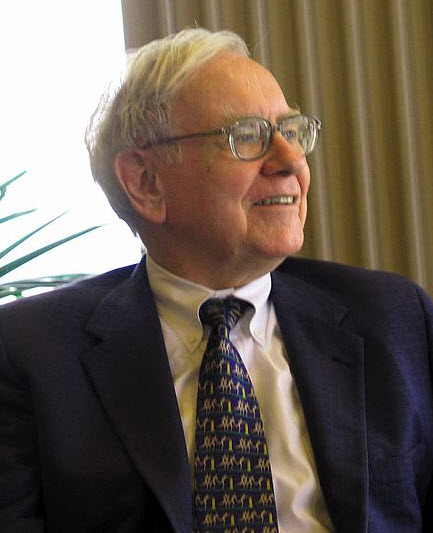

The insurance news that followed shortly after Warren Buffet’s birthday has indicated that while there is a positive future for investors in Berkshire Hathaway, there will need to be decisions made after the great man is no longer at the helm.

Berkshire is currently made up of over 80 businesses that brought in over $3 billion in profit during the last quarter. It has a Class A stock that continues to border on its own 52 week high that it set last month.

For this reason, s tockholders feel that the insurance news from this company is good.

tockholders feel that the insurance news from this company is good.

That said, now that Buffet has turned 82, and following a summer in which it was revealed that he had been undergoing prostate cancer radiation treatment, investors are starting to wonder what Berkshire will do one day in the future when Buffett will no longer be driving the company along.

The most recent insurance news is that the company will take slight steps back from that industry.

Moreover, a succession plan is in place for Berkshire, and investors have been reassured that not only was Buffet’s condition not life threatening and he is currently feeling well, but the board has also chosen not only one successor, but also has two more backup candidates to provide a Plan B (and C). That said, the man will not reveal the news of who the next CEO will be. At the moment, Buffet holds both that role, as well as the position of Chairman in the company.

Equally, as Buffet has revealed that Berkshire will be holding less of a reliance on news into its future, it has still been quite active in its deal-making. It is that task that Buffet enjoys enough that he has stated that he has no intentions of stepping down. The most recent acquisition by the company was in 2011, when it took in Lubrizol, a chemical making company, for $9 billion.

Whoever the successor will be will have quite a broad and evolving conglomerate to control. Though it is not finding itself in insurance news quite as much, it remains within that industry as well as its manufacturing, utility, and railroad business, which have always been its foundation.