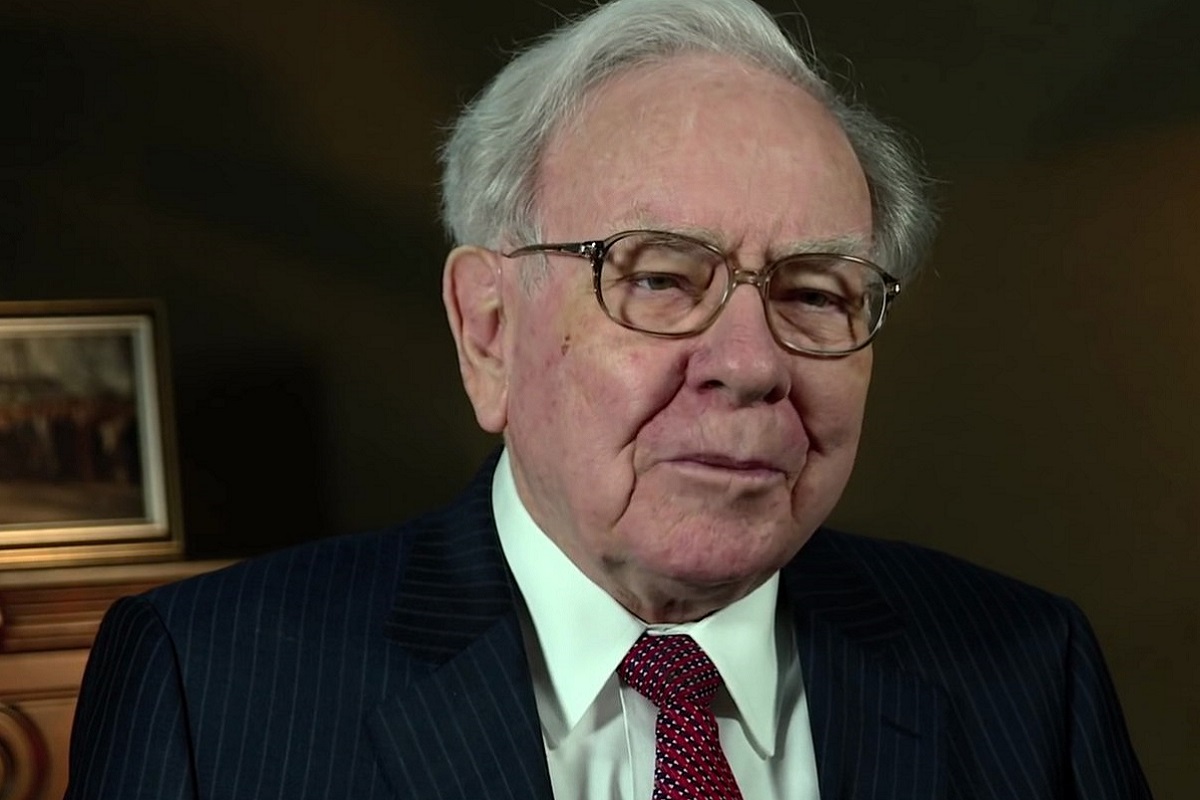

The purchase agreement was struck shortly after Warren Buffett discussed the lack of investing opportunities.

Berkshire Hathaway Inc. has arrived at a purchase agreement for the Alleghany Corp insurance company, only a handful of weeks after Warren Buffett had said that there weren’t any good investment opportunities.

The purchase includes Alleghany insurer as well as the Transatlantic Holdings reinsurer.

This acquisition of the reinsurance and insurance company will broaden Berkshire Hathaway’s portfolio in this category, which already includes the Geico auto insurer and the General Re reinsurer, in addition to a unit providing coverage against unusual risks and major catastrophes.

“Berkshire will be the perfect permanent home for Alleghany, a company that I have closely observed for 60 years,” said a statement from Warren Buffett, the head of Berkshire since 1965.

The purchase represents one of the largest the company has made in its entire history. It would also bring Buffett and Joseph Brandon back together again. Brandon was CEO of General Re from 2001 through 2008 and is now the CEO at Alleghany, after having taken the position at the end of last year.

The insurance company purchase also ends Buffett’s six year-long fast of large investments

The acquisition provides Buffett with the opportunity to use some of the $146.7 billion in cash and equivalents that Berkshire had by the close of 2021.

It was only February 26 when Buffett bemoaned the fact that “internal opportunities deliver far better returns than acquisitions,” in his annual shareholder letter. He added that there wasn’t much that “excites us” in the equity markets, committing to keeping $30 billion in cash on hand.

In the acquisition of Alleghany, Berkshire agreed to pay $848.02 in cash per share, which is a premium of about 25 percent over the closing price from last Friday. The acquisition is not yet final, as the insurance company still has the remainder of a 25-day “go-shop” period in which it can seek out a better offer than what Berkshire has made. The massive Omaha, Nebraska-based conglomerate does not participate in bidding wars. Should the transaction continue forward, it is expected to close in Q4 2022, pending Alleghany shareholder and regulatory approvals.