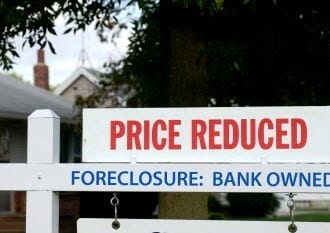

For the first time, Indiana homeowners will be able to purchase a form of insurance that protects them from losses in their home value due to shifts in the housing marketplace.

For the first time, Indiana homeowners will be able to purchase a form of insurance that protects them from losses in their home value due to shifts in the housing marketplace.

This Home Value Protection insurance is available in Indiana as of this week and is the only form of American policy that helps to reduce the risk of homeownership due to swings in the housing market. Homeowners who purchase this policy will have the peace of mind of knowing that the market value of their largest financial asset is secure, regardless of the volatile cycles of the marketplace.

Home Value Insurance Company CEO Scott Ryles explained that the prices of housing have become increasingly difficult to predict, and they will continue to be this way. He added, however, that the policy offered by his company, which costs only between $1 and $2 per day, depending on the home, “gives Indiana homeowners greater control over the value of their home investment, and peace of mind in a volatile housing market.”

Ryles explained that although homeowners have traditionally had access to protection against events such as natural catastrophes, as well as fires and other devastating circumstances – which are fortunately quite rare – until now, they have not had protection against a risk that has recently impacted all homeowners, which is a loss in the value of their home due to the market.

Data from research performed by Home Value Insurance Company has indicated that 58 percent of homeowners are aware that the risk that is most likely to financially impact their home is the loss of its value. This policy protects against that form of loss.