Last month, Ohio’s Home Value Insurance Company launched a new insurance product dubbed Home Value Protection Insurance. The insurance plan is the first in the nation to provide protection against falling home prices due to a volatile market. Since announcing the plan, more than 75 independent insurance agents have applied to sell it, making Home Value Protection Insurance one of the most popular policies amongst agents in the nation. Given that the plan has no equal, there is an unprecedented opportunity for agents able to sell the product.

Last month, Ohio’s Home Value Insurance Company launched a new insurance product dubbed Home Value Protection Insurance. The insurance plan is the first in the nation to provide protection against falling home prices due to a volatile market. Since announcing the plan, more than 75 independent insurance agents have applied to sell it, making Home Value Protection Insurance one of the most popular policies amongst agents in the nation. Given that the plan has no equal, there is an unprecedented opportunity for agents able to sell the product.

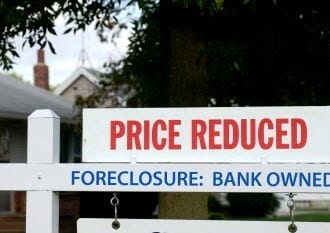

The coverage plan was created as a response to overwhelming demand from consumers for protection against a housing market rife with risk. The plan ensures that the value of a home, after it is purchased, will not decrease due to unforeseeable faults in the market. This will provide homeowners with a certain level of financial security depending on the value of their home. The policy is expected to be especially popular in Ohio, where the value of properties in the state has fallen by 18% since 2006.

The sheer potential of the policy has attracted a large number of independent insurance agents. Out of state agents have been expressing interest in the policy as well and have begun pushing for similar plans to be introduced in their states. Whether other states will adopt similar policies remains to be seen, as Home Value Insurance Company’s plan was the products of more than two years of intensive development, and many insurers have expressed want to wait until after 2014 to introduce major insurance plans that may or may not meet federal regulations.