Hurricane Isaac spurs unexpected expenses

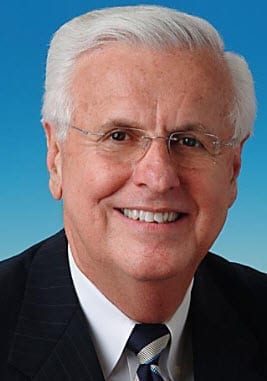

Louisiana continues to struggle in the wake of Hurricane Isaac, which struck the state and other in late August. Insurers and state officials have been working to repair the damage caused by the storm and assist those that have been displaced by the disastrous floods it caused. While state residents continue to piece their lives back together, they may soon face new problems from the state’s insurance industry. Insurance Commission er Jim Donelon has announced that consumers can expect to see higher out-of-pocket expenses as a direct result of Hurricane Isaac.

er Jim Donelon has announced that consumers can expect to see higher out-of-pocket expenses as a direct result of Hurricane Isaac.

Insurance Commissioner highlights high deductibles

Homeowners and businesses filing claims are likely to see unexpected expenses due to deductibles that are common in many insurance policies offered in the state but receive relatively little attention. notes that many of Louisiana’s insurance companies have deductibles concerning hurricanes and other named storms. Typically, these deductibles range from 2-5% of the full insured value of a property that is receiving coverage. This does not only apply to the damage inflicted by a natural disaster.

Largely unknown deductibles could cause financial problems for many

Donelon notes that some homeowners could pay as much as a $7,500 deductible for a $9,000 roof repair, while some businesses are expected to pay larger sums. The Commissioner suggests that consumers are somewhat shocked by the fact that they could be paying thousands to repair damage that they believed would be covered by their insurance provider. Donelon’s estimates are primarily regarding wind damage as most of the state’s property insurers do not offer flood protection as an inherent feature of a homeowner’s insurance policy.

Hurricane Isaac continues to cause problems long after abating

Commissioner Donelon regularly calls attention to the importance of reviewing insurance policies, especially before major natural disasters are expected to hit. Though Hurricane Isaac has exacted a heavy toll against consumers, Donelon believes that the disaster may have provided some with the wake-up call they needed to take a closer look at the insurance policies that are meant to protect them.