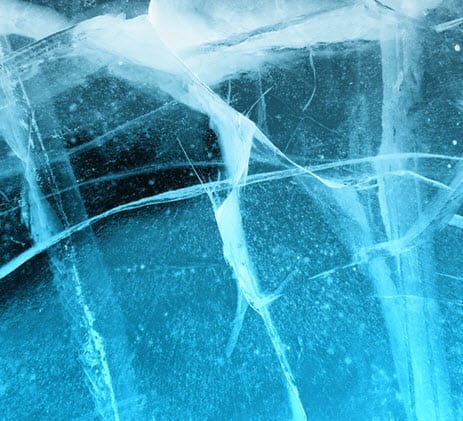

The time has come for winter proofing homes and properties to help prevent damage.

Though the majority of damage caused by winter storms is covered by homeowners insurance, it is highly recommended that efforts be taken to help protect the home against harm from frost, freezing, snow, wind, and other problems throughout the  colder season.

colder season.

Some areas of the country have already experienced weather advisories for frost and freezing temperatures.

Though these signs of winter are still very early, they are an important signal of how close the season truly is, and that it is better to start to use preventative action now than to wait until snow is already starting to collect. According to the Insurance Information Institute (I.I.I.), a large amount of damage related to winter storms can be prevented if homeowners insurance policyholders would just take a few basic steps to prevent snow, wind, and freezing temperatures from taking their toll.

Standard homeowners insurance will provide protection, but it’s better not to have to make a claim.

According to I.I.I. consumer spokesperson and senior vice president, Jeanne M. Salvatore, “Standard homeowners insurance policies cover winter-related disasters such as burst pipes, ice dams, and wind damage caused by weight of ice or snow, as well as fire-related losses.” Salvatore went on to explain that the National Flood Insurance Program and some private insurers will offer flooding coverage and that damage to cars from winter related issues is typically available under an auto policy’s comprehensive portion.

It’s important to remember that it isn’t just frozen snow that can cause property damage, but also melting snow. In fact, melting snow and winter storms make up one third of all of the catastrophe losses in the united states. In 2011, winter storms were considered the third most expensive form of natural disaster, racking up approximately $2 billion in insured losses that year (according to a Munich Re report).

In the two decades ending in 2010, homeowners insurance records showed that winter storms were responsible for claims worth $26 billion. This expense was the equivalent to $1 billion in winter storm catastrophe losses every year.