The Home Value Protection insurance policy – the only one in the United States offering homeowners protection from the catastrophic effects of withered home prices – has now become available to homeowners in Oklahoma.

The Home Value Protection insurance policy – the only one in the United States offering homeowners protection from the catastrophic effects of withered home prices – has now become available to homeowners in Oklahoma.

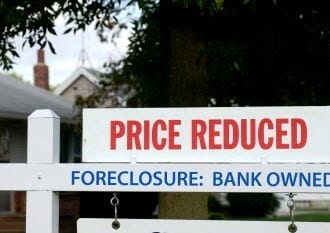

Homeowners who are covered by this policy will have a greater amount of protection for their investments, which is typically the largest they will hold in their lifetimes, as the prices of their homes continue to plummet.

Oklahoma is the second state in the country that will have this unique form of insurance policy available to homeowners who wish to cover their owner-occupied, primary residences. The Home Value Insurance Company will be offering this policy. It is a licensed insurer that undergoes regulation by the Oklahoma Department of Insurance.

According to the Home Value Insurance Company’s CEO, Scott Ryles, this policy’s coverage gives homeowners peace of mind from knowing that they needn’t worry that they will be losing equity in their home or that they could end up drowning in debt. He added that “For a very affordable premium, they can protect themselves from downside risk, while still benefitting from the upside when home values appreciate.”

The protection was first introduced last year in Ohio. Ryles stated that this innovative new form of coverage is already providing many policyholders in Ohio, a state which has been hard hit by real estate struggles and that experienced an average drop in home values of $1,600 in the third quarter of 2011 alone.

Ryles explained that this insurance policy is helping to restore the confidence of potential homebuyers in the real estate marketplace, and that the company intends to continue its expansion into other states.