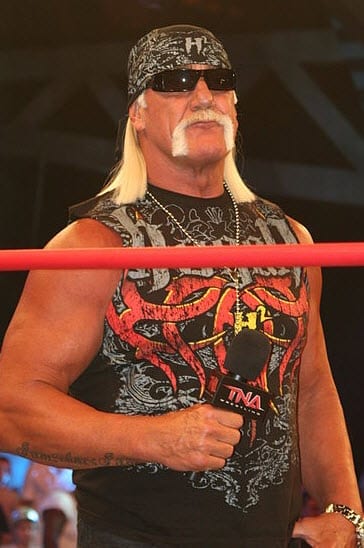

Wells Fargo Insurance Services Inc. in Florida has been sued for business malpractice by celebrity Hulk Hogan. Mr. Hogan (real name Terry Bollea) sued Wells Fargo for failing to protect his assets properly, by providing him with an umbrella policy.

Wells Fargo Insurance Services Inc. in Florida has been sued for business malpractice by celebrity Hulk Hogan. Mr. Hogan (real name Terry Bollea) sued Wells Fargo for failing to protect his assets properly, by providing him with an umbrella policy.

Mr. Hogan was sued over an auto accident his son had in 2007, which left a passenger in his car with permanent brain damage. Even though both vehicles involved in the accident were his own; his vehicles’ insurance maximum payment was 250 thousand, per vehicle. With inadequate coverage, he was left to pay the settlement on his own.

In an attempt to recoup some of his loss, Hogan filed a business malpractice suit against his insurance broker and his insurance carrier. Hogan commented that his agent should have better protected him because of his considerable amount of assets; adding that having newly licensed teenage drivers put him at an increased level of liability also.

During the hearing, it was revealed that his insurance agent had made several attempts to get the Hogan’s to purchase additional coverage. Hogan’s then-wife had been approached at least four times regarding purchasing additional coverage for their protection. She refused the services on all accounts.

Hogan himself was never approached regarding purchasing an umbrella policy; at that time, the agent dealt directly with Hogan’s wife. The Pinellas County Judge dismissed Hogan’s lawsuit against Wells Fargo.

Having a personal umbrella policy could have protected Mr. Hogan. Umbrella policies were created to protect a person from high-dollar liability cases. Having this coverage can help protect your personal assets (retirement funds, bonds, savings, home) in the event of a large liability lawsuit.