The more fancy gadgets become commonplace in cars, the more expensive it becomes to repair them.

Technology designed to make cars safer and more convenient may reduce accident frequency but may also be increasing auto insurance premiums.

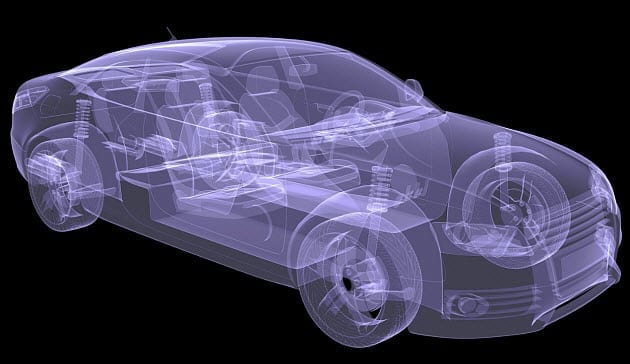

Tech enhancements include everything from touch screen control panels, backup cameras, blind spot monitoring and additional help to keep us aware of what’s going on around us. However, those gadgets aren’t cheap. When they do become damaged in a car crash, the repairs are more costly. As a result, the claim payment is higher, increasing auto insurance premiums in order to compensate for the size of those claims.

Even if they are helping drivers to be more aware on the roads, the higher cost of repairs when accidents do happen is greater than the savings from any potential reduction in collisions as a whole.

“If they’re damaged, they’re much more expensive to repair,” said Insurance Information Institute chief actuary, James Lynch. “You can’t just go to a shop and pick up a part that you can jerry-rig on.”

“If they’re damaged, they’re much more expensive to repair,” said Insurance Information Institute chief actuary, James Lynch. “You can’t just go to a shop and pick up a part that you can jerry-rig on.”

At one time, repairing a damaged bumper was a very basic, standard job. However, when repairing the bumper of a newer model with embedded sensors and cameras, the cost can skyrocket.

For instance, Liberty Mutual Insurance data shows that a 2014 entry-level luxury car’s bumper repair would have cost an average of $1,845 for both parts and labor. However, a 2016 model of the same vehicle would come with a bill for an average of $3,550 for parts and labor for a bumper repair.

All the additional sensor technologies in the newer models are costly to repair or replace. Moreover, these gadgets, such as sensors on bumpers and side mirrors, are all located in parts of a vehicle that are easily struck even in minor fender benders. This has driven the cost of affected parts upward by 130 percent and labor is 18 percent higher to cover the extra tech requirement and time.

As a result of these added costs, the expenses are reflected in increasing auto insurance premiums. Therefore, despite improved safety for the people inside vehicles because crashes are more minor, their insurance rates continue to rise.