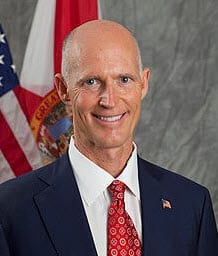

Florida Governor Rick Scott is pressuring lawmakers to make changes to some of the state’s auto and property insurance laws. The Governor claims that these laws are each costing consumers millions of dollars. Legislators have been trying to find a resolution for the issue for over a decade but have so far been unable to make any headway. Governor Scott is now pushing for a solution to be found quickly to prevent further financial stresses falling upon consumers.

Florida Governor Rick Scott is pressuring lawmakers to make changes to some of the state’s auto and property insurance laws. The Governor claims that these laws are each costing consumers millions of dollars. Legislators have been trying to find a resolution for the issue for over a decade but have so far been unable to make any headway. Governor Scott is now pushing for a solution to be found quickly to prevent further financial stresses falling upon consumers.

State law requires Floridian drivers to purchase personal injury protection. The issue with the law concerns the rampant level of fraud throughout the state, which adds several hundred dollars to the premiums policyholders pay each month. The cost of these policies is rising quickly due to fraud and Governor Scott is looking for more aggressive laws concerning the matter. The Governor is also looking to stymie the growing costs of Florida’s Citizens Property Insurance group, which provides coverage to more than 1.5 million homeowners throughout the state.

The issue of fraud is growing more dire, as the Insurance Information Institute estimates that fraudulent activities concerning auto and property insurance could cost the state $1 billion by the end of the year. If lawmakers cannot find a solution to the problem, consumers can expect to pay much more for their insurance coverage each year, as insurers attempt to mitigate the losses generated by fraud.