FEMA introduces revised flood maps that could expand flood insurance requirements

FEMA introduces revised flood maps that could expand flood insurance requirements

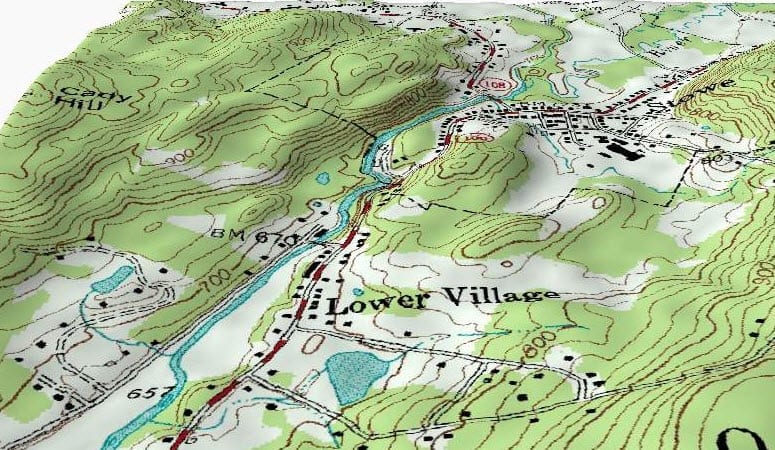

The Federal Emergency Management Agency (FEMA) has introduced new flood maps for the East Coast U.S. this week that could force many property owners and businesses to purchase flood insurance coverage. The federal agency has been working to revise flood maps over the past two years, addressing some of the emerging threats that have been brought to light by powerful storms, such as Hurricane Sandy. These storms have caused widespread flooding in many parts of the East Coast and in the south, thus driving up the need for flood insurance protection.

Flood maps could impact 35,000 properties in New York alone

Flood maps from FEMA are widely used in the U.S. insurance industry to determine coverage options for property owners. The maps also have an effect on building laws in their representative areas. Buildings, whether they belong to consumers or businesses, that are in flood-prone regions are often required to be covered by some form of flood insurance coverage. The new flood maps from FEMA could mean that as many as 35,000 more properties in the New York City area alone will need to be covered by flood insurance.

Hurricane Sandy influences revision to flood maps

The revised flood maps from FEMA are currently preliminary and have not taken effect. The maps are likely to become the basis for insurance requirements in the coming years, however. FEMA notes that the impact of Hurricane Sandy has influenced the development of the new flood maps. The powerful storm caused devastating flooding throughout much of New York City and New Jersey, with floods causing damage in areas that have, in the past, been free of such disasters. FEMA has taken steps to expand what it considers to be high risk zones.

Property owners likely to turn to National Flood Insurance Program

Once the revised flood maps are finalized, property owners that find themselves in flood zones are likely to turn to the National Flood Insurance Program for the coverage they need. The federal program offers affordable flood insurance coverage to those that cannot find it from private insurance companies. These companies often avoid offering flood insurance policies because of the high financial risks associated with natural disasters that generate flooding.